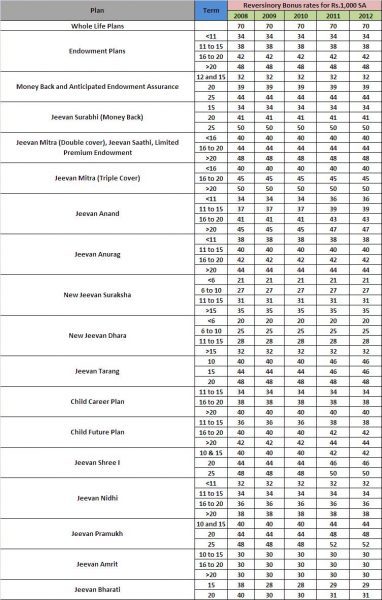

LIC declared it’s bonus rate on 1st September 2012 for the year 2012. Let us see how much are they and compare with last 5 years bonus rates. Latest rates are available in my latest post “LIC’s Bonus rates for 2013-14 and Comparison“.

Above Bonus rates for 2012 will be applicable for policies entered during the inter valuation period (01-04-2011 to 31-0302012) and in force for full SA as on 31-03-2012. It also apply for the policies whose death, maturity or surrender occurs on or after 01-01-2013. Also above 2012 bonus rate applicable who entered after 31-03-2012 and result into claims, maturity or surrender during the period commencing from 01-01-2013 and ending 9 months from the date of next valuation.

I considered only the plans which are currently offering by LIC. You notice from above table that Bonus rates are not changed to what it was previous year. Positive point is, it maintained the same increased rate of bonus rate for Jeevan Anand (which was raised previous year for all tenures). I mentioned here Jeevan Anand because it is one of the highest selling insurance plan.

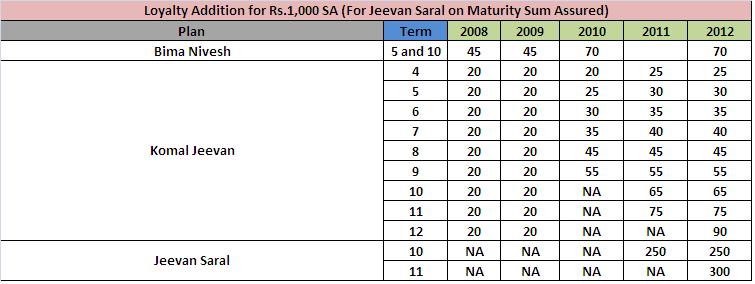

Below are Loyalty Addition rates for few selected policies. I considered Bima Nivesh, Komal Jeevan and Jeevan Saral.

For Jeevan Saral if the policy is in force for atleast 10 years and full premium paid for all 10 years then loyalty addition is payable or due to earlier death for complete duration for which the premiums have been paid.

Also if death claim occurs in the 10th year of the policy and the policy is in full force then loyalty addition is payable.

If policy surrendered after completion of 10 years, provided 10 full years premiums have been paid under the policy, loyalty addition will be payable for the complete duration for which premiums paid.

Hope this information will helpful for policy holders.

If you have any specif doubt about LIC’s Jeevan Saral Plan then I request you all to raise your queries by commenting on the post LIC’s Jeevan Saral-Why so much confusion?

636 Responses

Could you tell me the Jeena Saral 2012-13 policy loyalty addition annual premium band ?

Dear Antony,

It is not available with me. Better you cross-check with LIC.

Sir I have a lic policy of new bima gold money back in 2009 for 12 years. Sum assured is 4 lac. In 2021 it will be matured . What amount I get

Dear Raja,

Contact branch.

Hi Sir,

My age is 29 and I have taken Jeevan Anand Policy(149) 2 years back. I am paying 50103 every year(once in a year) and the term is 21 years. I was told by my agent that I will be getting 20 lakhs upon maturity whereas the sum assured is displayed as 10 lakhs.

Could you please confirm what would be the sum assured in my case upon maturity?

Sudarshan-Sum Assured will not vary. So it will be Rs.10 lakhs only. But in my view, your agent provided you the maturity amount.

dear sir my present age is 39, i have 2 kinds one is 12yrs baby and other is 6 yrs boy.

i want to give 20 lakhs each at their age of 27. which plan is best for me.

give me details. as early as possible.

Raj-Whether the Rs.20 lakh is in today’s term or the value once they reach 27 years? To be frank, don’t run behind these policies.

Hi Basu,

Can you help me with an understanding whether bonus accrues on Jeevan Anand policy in the year of commencement? I have 2 jeevan anand policies and need this for better financial decision making.

Rgds

Sachin

Sachin-First analyze whether you did better financial decision by buying these two plans? Bonus rates are available in above chart. What else you need??

Mr. Basavaraj Tonagatti

please advice me-

I have three Jeevan Saral policy yearly premium 30024,48040 and 24020 in the year December,2009 and March,2010.I am confused what should I do close the policies this year that is after five years or continue at least 10 years ?-please advice.And if I surrender then what should I decide for next Investment with same amount of premium? please reply soon.thanks.

Biswajit-Please go through below comments related to Jeevan Saral and you will find my answer.

Dear Mr. Basavraj,

I have taken a Jeevan Shree Policy in year 2002 for Rs.5,00,000/- Sum Assured. Yearly I have paid Rs. 51,341/-. I have paid for 10 years without any break. LIC has told me that this policy shall mature after15 years, i.e in 2017. When I am trying to check about the maturity amount I shall be getting, I did not get any clear picture from any one person in LIC.

Can you please let me know what shall be the maturity value I shall be getting. I was told when policy is being taken I shall get a maturity value of 4 times the SA i.e Rs.20 Lacs. Is it so?

Appreciate your early and positive reply.

Murali Venkat

8499996388

Murali-Please check your policy document. You will get all information on it.

Hi Basavraj,

I have a LIC Jeevan Saral (T No: 165) policy. Here are the details of it:

DOC: 17/01/2010

Sum Assured: 10 lacks

Policy Term: 21 years

Age while commencement: 24

Premium Amount per month: 4043/-

Could you please let me know the maturity amount that I will get?

Thanks,

Hidayat

Hidayat-There are numerous replies in below comments related to Jeevan Saral. Request you to read all of them in detail.

DEAR SIR,

I ONLY NEED YOUR ADVICE PLEASE; I HAVE A LIC JEEVEN SARAL PLAN OF 26 YEARS TERM OF RS. 11, 25,000/- IF THE POLICY IS BEING SURRENDERED BY ME AFTER FIVE YEARS THEN THERE HAS BEEN ANY KINDS OF LOOSES. AND IF I HAVE TO CONTINUE THIS PLAN TILL MATURITY THEN THE VERY TIME WILL BE ANY KIND OF LOOSES WHILE VIEWING AT THE TIME OF PRESENT TO FUTURE. PLEASE TELL ME ABOUT I WOULD LIKE TO KNOW ABOUT THAT I HAVE DISCONTINUED THE POLICY AROUND TO FIVE YEARS, IF I AM WRONG SO PLEASE TELL ME ABOUT IT. WHAT DO I DO FOR THIS TIME ?

REGARDS!

Mohit-Please read comments related to Jeevan Saral. You will find my answer.

Sir,

I only would like to know about if I have discontinued the policy after five years, I will have gone to loose side or not. If I continued the policy that is safer side or going to gain profit or loose.

Please reply my query.

Thanks

Mohit-In case of 5 years closure even if you loose something from what you paid already, is safer than committing a same mistake for rest of policy period. If you are satisfied with kind of return then you can go ahead 🙂

Sir,

How long period I have to continue this policy, what is your advice if my policy has been terms 26 years. Please suggest me how long years have I to continue the very policy? After that I have no loose at the end of the policy.

And also please let me know what will I get form LIC after five years if I discontinued my policy (including M.S.A & L.A. declared by corporation)

Sir,

How long period I have to continue this policy, what is your advice if my policy has been terms 26 years. Please suggest me how long years have I to continue the very policy? After that I have no loose at the end of the policy.

And also please let me know what will I get form LIC after five years if I discontinued my policy (including M.S.A & L.A. declared by corporation)

Mohit-By running behind year on year to get what you paid you actually looser by committing a same mistake. In my view it is best to come out after 5 years. If you continue for 10 years then you may get what you paid with that around 4% to 5%. Is it good decision?? I don’t have any data to claim you how much you get after 5 years. So contact LIC office.

Hi sir,

I HAVE LIC JEEVAN ANAND POLICY, SUMASSURED 10,00,000.JOINT ON JANUARY 2004,MATURITY DATE 21YEARS. HOW MUCH WILL GET APPROXIMATELY IN MATURITY DATE.

Easow-It will be around 6%.

Dear Sir,

I had a Jeevan Anand policy with following details:

1. DoC = 28th May 2004

2. DoM= 28th May 2014

3. SA = 10,00,000/-

4. Premium Paid = 127,383/- for 10 years

Could you please let me know what should be the total amount that I should receive at maturity (i.e. on 28th may 2014) ?’

Thanks in Advance

Ritesh-In whatever way we calculate, return will be around 6%. Are you satisfied with it?

Hello sir, first of all thank you for the reply.

In my current situation, I would have been happy even if the return was around 6%.

Annuity Due of Rs 127,383, for 10 years at return of 6% p.a. would yield Rs 17,79,750/- on maturity.

But as far as I know the return has only been 13,53,000/- which is disgusting. My agent had promised me that at Maturity i would receive around 17 Lacs, but currently it is nowhere near that.

Please let me know if 13,53,000 is the correct sum to be received on Maturity or has there been any mistake from LIC?

Ritesh-I am not quoting the exact return. But do think 6% for such a long term is good investment decision, especially when inflation rate itself is around 8%. Means your investment is actually giving you negative return of 2%.

dear sir,

i have a money back polici.amount of half yearly rs-2744.for 20 years snd money back is 16000 per 4 years..Please tell me about houw much return can I expect on maturity.

Chinmay-It will be around 5%-6%.

Dear Sir,

I have a Jeevan Anand(table 149) policy.The details are:

DOC:06/07/2013

DOM:06/07/2090

DLP:06/07/2028

SA:1000000

DOB:09/06/1990

Please tell me about houw much return can I expect on maturity.

Pratay-First let me know how much return your agent told you during buying of this plan.

I have a 20 years jeevan anand policy with a yearly premium of 25000/-. I would like to take a loan against the policy. how much loan shall i get and is there any affect on maturity benefits due to loan. Also indicate the rate of interest against loan.

Kindly advise.

Vinod-Request you to contact your servicing branch or nearest LIC branch regarding how much loan amount you will get from policy. If you opted for loan then there will be no such changes in final return you receive from the plan. Hence no need to worry. You can visit my post “LIC’s revised (2012-13) interest rates for Policy Loans, Revival and Dating Back” for detailed interest rate on your loan.

Dear Basu,

I am SUBRAMANIAN. I took two policies .one for me and one for my wife.Both

Jeevan Mitra(Doubie Cover Endowment Plan) in the Aug 1993 Tab & Term 88-20.

Sum assured for me is Rs 35000/ and Rs 30000/ for my wife. For some

unexpected reasons we could not pay the premium from Sep 2006. If we submit

the policies now how much we will get? Whether the policies will be eligible all

the benefits. I request you to help me in this matter. I am very much absorbed by

your help to the needy people .Wish you all the best all the time in the world.

R.Subramanian-If you at least paid 3 years of premium then your eligible for surrender. I am unable to say how much you will get. Instead I suggest to visit your nearest LIC branch or servicing branch to know the exact status of policy.

Thank you

Hello Basu,

After paying premiums for 13 years Which will be more beneficial

a) Surrendering at the end of 13th year,

b) Surrendering after the due date.

What are all the benefits ie the bonus etc and what is the calculation

for both a) and b)

Warm Regards

Subramanian

Subramanian-For both answers, I request you to contact nearest LIC branch. They will exactly give before and after 13th year surrender values. Because surrender values depend on so many things.

Hi Sir,

I am planning to buy New Bima Bachat Policy for my nephew who is 17 years old for 9 years term.

The one time premium is Rs. 74447 for SA Rs. 100000.

The advisor told me that my nephew will get 15% of SA at the end of 3rd and 6th year and the end of 9th year he will get Rs. 100000+40000=Rs. 140000.

Now one of my friend told me that at the time of maturity the amount will be the one time premium plus loyalty addition only which will be well below Rs. 140000.

I want to know whether the contention of my friend is right? and if so how much amount(approx) will my nephew get at the time of maturity apart from 15% money back at the end of 3rd and 6th year.

Thanks in advance.

Hemant-What your friend quoted is correct. This being traditional plan, return will be around 6% from all your investments. Also I don’t think what is prompting you to buy a traditional product for 9 years. If you put the same in FDs then you have possibility to earn more than this product.

Thanks a lot for your guidance Sir.

Hello Basu,

I have a Jeevan Saral policy ,in which 10 year complete in 2022 so i want to know that i got a loyality addition on basis of 2022 declare or on basis of 10 year term plan i.e. you mentioned in bonus chart.

Thanks

Rahul

Rahul-It will be based on LA rate @ 2022 for 10 year term Jeevan Saral Plan.

Hello Bashu,

i have a policy of jeevan saral and 10 year complete in 2022 .If i mature i got a loyality addition value on basis of 2022 declaration or 10 year completion i.e. on 2011 basis ?

Rahul-It will be 2022 LA for 10 year term.

Hello basunivesh,

I have LIC’s Javeen Shree 1, 20yr Terms, premium @ 30300/- P.A for 16yr,

What amount will i get after 20year (in 2030)?

Thanks in advance.

Farooqi-It is typical traditional plan where in only adding features are minimum SA is Rs.5,00,000 and for the first 5 years Guaranteed Addition (after that normal bonus declaration as usual to other plans). So you can expect around 7% return.

Thanks

SA is 6,00,000/-

By calculating @ 7% i should get 1454573.9/- right? or else?

Farooqi-It is around Rs.12,42,163 (I considered period as T=20 Years, return on investment R=7% and yearly contribution PMT=Rs.30,300). You need to calculate FV (Future Value).

Dear Sir,

I had taken jeevan tarang policy which premium 71369 annual for 20 years with sum assured 14.5 laks. My advisor told me that if you withdraw plan before six month in case of this policy ( safe surrender mode) then you will get about 36 laks (sum assured+bonus+loyality) pls. tell me is it true.

Praveen-It is completely baseless. Let ask him on what base he is claiming that you will get Rs.36 Lakhs.

Sir, Please send the Jeevan Ankur policy details and Bonus availed for previous years. pleaseee.. Mail ID: [email protected]

Durga Prasad-What special you need from me. All the details will be available on the LIC site itself.

Hello Bashu,

Have a LIC declared a Loyality addition of jeevan Saral for 2012 and 2013?if yes please tell how much?

Rahul-The same is available on above post. Please have a look into it properly.

Hi Basu,

I am grateful to your blog and i appreciate the effort made by you.

I had taken LIC Jeevan Anand plan for 21 years & 25000/yr on 3rd Nov 2012, so only paid 1 premium till now

I have few personal reasons and priorities to reduce the term from 21 to 10 year.

I got a call from LIC Cannaught Place Office saying that my plan can be converted into Jeevan Saral ( 10 Yrs plan ) with following

Details :

———–

1. Old 25k paid in Jeevan Anand will get added in Jeevan Saral and will be paid to me on 11th year along with SA of 5lakhs.

2. I will pay 24k / year till 10th year.

Additional Benefits :

—————————–

1. Loyalty Bonus 5k per year and will be paid on 11th year.

2. IRR Bonus 5k every year will be paid to me as cheque.

3. After maturity a life insurance of 5 Lakhs / 10 Lakhs normal insurance/accidental death insurance for next 25 yrs.

I could find details on the website but could not find additional benefits on website for table no 165.

Caller says, additional benefits may not be available on website as they are providing it on their behalf.

If conversion is possible i would like to go for it, but i am not able to judge the authenticity, please help.

Thanks,

Chandan Kumar

Chandan-It is a big mis-selling technique going on from someone to fool you. Please don’t be in this trap. First thing, there is no such option available with LIC where they can adjust the paid premium of one plan towards the one more new plan. So here they are completely claiming wrong. Even if you go with Jeevan Saral plan for 10 year tenure then the return on investment (considering the current LA trend) will be around 4%. So never ever enter into this trap. Also what they are claiming to be additional benefits are completely against rules. So what gaurantee they can provide you that after 10 year they will pay you? If they not then to whom you have authority to claim?

My sinciere advice will be to discontinue the Jeevan Anand. If you want to continue then you can. But NEVER NEVER NEVER enter into this new investment. This is a big caution from end to you.

Hmm Thanks for the suggestion about Conversion of my Plan…

Now although my previous Jeevan Anand Plan is going fine, but only personal issue for me is the “long” term.

I have only paid 1 premium till now, If i discontinue existing jeevan anand would i get anything ?

Even if i can get 50%, i would like to go for it.

And if i will get nothing, then i would like to reduce the term from 21 yrs to 10yrs.

Is it possible ?

Thanks,

Chandan Kumar

Chandan-These are the plans where your long term investment will only give you a bit good return. So it is of no use thinking now. No you will not get anything as premium payment will not completed minimum 3 years. But my suggestion will be discontinue and start a fresh with Term Plan (SA must be equl to 10-12 times of your yearly income)+Goal Based Investment (Choosing products based on your goals).

Thanks a lot for the information, that is ans am expecting from you . thx a lot…

Sandeep-Pleasure 🙂

Basav so much thanks for your reply but am in bit confusion for the amount that i might receive at the maturity period as per lic sheet they said @10% rate of int i will be receiving some xxx amount can i beleive that chart, am still in bit confusion , i request you clarify me in detail currently paying 2042/- rs p.m for 16 years already 2 years completed started at age of 26, now tell me how much amount would i expect at the time of marturity. thanks sandeep

Sandeep-10% return showing from LIC sheet is indicative return. This example will give you an idea how the plan actually works. But it does not mean that you will guaranteedly receive this much. In my view for 16 years of policy the return from this plan will be around 6%.

hello sir,

from the above table i could get that 300 rupees for every 1000 rupees in SA,so that means present LA rate is 3%.then how you are saying it would be around 6%.please could you clarify this to me.

Johnkrishna-I think you are referring to LA of Jeevan Saral. If it is so, then for your information LA will not be on SA on this plan but it is on MSA. Please read the table carefully also above few comments. So SA is different than MSA in Jeevan Saral plan. Also having Rs.1,00,000 today as cash in your hand is different than having the same Rs.1,00,000 after 20 years. The value of this Rs.1, 00,000 after 20 years will be less than what you have today. So bonus or LA declared today seems good but you receive it either on maturity or claim. Hence the value gets reduced.

If you still have doubts then let me know.

Thank you sir for your reply.yes i was referring to jeevan saral policy only.i am paying monthly 4000 rupees for my jeevan saral policy.though in bond they mentioned 35 years as my maturity period,but i am planning only for 15 years.my policy commencement date was 15th march 2009.may i know what would be the approximate amount as per the present trend is considering i get at the time of my maturity(after 15years from policy starting date) ?by the by what is the difference between SA and MSA?

Johnkrishna-May I know the age when you took this policy? The difference between SA and MSA is-SA is the risk you will get throughout the period of this policy, I mean your nominee will receive in case of your death during the policy period. Where as MSA is the guaranteed value you receive from this policy at the end of term.

Thanks for the clarification sir.my age when i took this policy was 26 and policy starting date was 15thmarch2010.

Johnkrishna-Your MSA for 15 years will be Rs.7,79,760 and LA will be Rs.3,70,386. (LA @ Rs.475 per Rs.1,000 MSA and premium paying policies of Rs.20,001 to Rs.50,000). So total you may receive Rs.11,0,146.

Hi

I have a Jeevan Saral of Rs 24000/- annual premium for a term of 35 years which started in 2009.

I am 30 years old now.

Wanted to know

a) From which year will the surrender value also include the loyalty additions? And will it include the LAs in full as per last declared?

b) Is the LA different for different terms? You have mentioned terms as 10 & 11 and the LAs are different for both.

Thanks

Shashwat Virmani

Shashwat-My answers are as below.

a) In my view it will include from 5th year onward.

b) Yes LA depends on term of the policy.

hi Basau,

i am investing 1024/- and 2042/- p.m for my jeevan saral, for 12 and 16 years periods, wat would be apprx amount i would be receiving at maturit period and also send me rate of interest declared for last 2 years for jeevan saral, so i can plan my years accordingly – pls send the details to my id [email protected]

Sandeep-For your information Jeevan Saral not have any interest. Please first understand what are the basic things you must know about this policy by visiting the post link “LIC’s Jeevan Saral-Why so much confusion?“

sir,

presently i am in Dubai for oil and gas field job. next month I will come in India.

I want to invest 5 lac rupees next month.

pleas can you advice me where i have to invest with safety and Security.

other vice i have plan to invest in SBI NRE Account as a Fix Deposit. advice me this is the right way.

I am waiting for your favorable response.

Thank you for your favorable response.

hi

i invested 100000 rupees one time investment in bima nivesh for 5 years terms pleas can you tell me my maturity amount after 5 years?

Virendra-It is Rs.1,27,628 (GA at Rs.50 per Rs.1,000 SA)+LA (which I don’t know).

Sir approximate how much this LA (loyalty addition) Amount.

Virendra-Currently it is Rs.70 per Rs.1,000 SA. So in your case it will be around Rs.7,000.

Thanks Nasu

Hi Bashu,

I have invest a Rs73500 per year in JeevAN Saral for a term of 20 years.So how much return i would expect after 20 years.Is it good or not.

Now, i have heard a LIC closed all these policies and introduce a new policy.So it would effect on a return of jeevan Saral LOYALITY addition declare by LIC?

So can you please ellaborate is it benefit to contiue upto 20 years or exut after 10 year investment?

Thanks and Regards

Rahul

Rahul-Return from this plan will hover around 6%-7%. Now you may conclude yourself whether it is a good plan or bad plan. No as of now none of existing plans of LIC’s are closed. That revamp postponed to 1st Jan 2014. So even if they change there also will be no effect to the existing clients. Don’t worry as of now.

hi

i invested 100000 rupees one time investment in bima nivesh for 5 years terms pleas can you tell me my maturity amount after 5 years?

pleas send me maturity amount on my email address : [email protected]

Virendra-It is Rs.1,27,628 (GA at Rs.50 per Rs.1,000 SA)+LA (which I don’t know).

Thanks Basu, I get your point here. Can the above plan go into guaranteed returns category same as debt instruments. What are the other options you suggest in terms of maximum returns? I’m confused with MF or SIPs. Ofcourse I’m still collecting knowledge.

correction – i meant to say I’m spending 30,000 per annum.

Thanks Basu, 9 lac is guranteed returns and there is bonus component which takes it to 71 lac. so I assume it will be higher than 9 lac at any point in time? Also I’m spending 30,000 per month on this plan.

Hvishal-What will be the value of Rs.71,00,000 at your age of 80 years? It may be around few years’ expenses. So don’t run behind values in current terms. My suggestion will be not put more than 20% of your overall investable amount into this plan. Now it is your call to take.

Hi Basu

Thanks for all your valuable comments. I need your help to understand whether I’m going for right plan.

My LIC agent has suggested me Limited payment whole life with profit plan (table 5). Premium per year is 31000. SA is 9,00,000. Premium paying terms is 20 years. Maturity is at age of 80. Risk cover given is 9 lac from first year and keep on increasing till 71 lac towards the maturity i.e. it increases by 50,000 every year. Maturity benefit is around 71 lac. Can you please let me know if this is good plan to buy, as risk cover appear to be good. Of course the guaranteed risk cover is 9 lac but including bonuses it goes upto 71 lac. Please help.

Hvishal-It is a good plan but the return from this plan will be around 8%. So treat this plan as if any other debt products like FDs, PPF or EPF. So don’t over invest in this plan especially for your long term investments. Debt portion of your total portfolio may go towards this. But not 100% of your investment.

Another thing about Sum Assured, you said risk cover appears good. How? Ideal insurance cover should be around 12-15 times of your yearly income. Is it actually matching your income? I don’t think so. Rs.9, 00,000 may sound good but will it fulfill your dependents dream in case of your untimely demise today itself? Think and act.

Hi BasuNivesh Sir,

please send me the SRBonus, TB, LA and any other bonus rate declared details for the child plans, such as the JEEVAN ANKUR, CHHAYA, ANURAG. Where parent is insured.

my email address is [email protected]

thanks

Prakash

Prakash-Done..check your mail.

Dear Nivesh,

Like Anand, I am also JS (old) customer and I joined it just before closure i.e. Jan’02. My queries are largely answered in this thread. My spcific queries are on futur action plan:

1. How can I get to know the current value of my policy? Unable to get it from online portal.

2. My view is that in any way, the naturity proceeds can’t go beyond 14-16 Lacs i.e. 4 x premiums paid over 16 yrs. Will it be advisable to surrender it, invest the proceeds as well as premium amount of 25k into a 8.5% PPF and get hugher returns than expected under exempt, exempt, exempt instrument?

Vivek-

1) If you are unable to get information from online portal then visit your any of the nearest LIC branch. They will give you the information on your policy.

2) Yes it is best option to come out of the plan and start the simple and tax efficient product which you mentioned. But at the same time not to forget to have the pure insurance plan called “Term Insurance”.

Hello Sir i need to take an LIC policy as i want to avail tax rebate. I have thought og New Bima Gold for 16yrs. Annual premium is 24459. I am 23 yrs old now. Is it a good policy to take.

How was Money Back policy?

Tanaya-Good to hear that you planned for tax planning. But will this money back plan actually match your financial goals? Return from such policies are around 6-7%. Are you ready for this? Don’t consider only on the tax preview look into another aspect of any product like whether it matches your need or not and then decide.

Thanks sir.One more query.I have taken a endowment plan in year 2000 at age of 23 for 15 years .The SA is 100000 for table no 14-15 and annual premium is 6700.can u tell me what will be the maturity amount i will received in 2015

Amit-SA Rs.1,00,000+Bonus Rs.57,000=Rs.1,57,000 (Bonus I considered @ Rs.38 per Rs.1,000 SA).

Thanks for reply.

Sir i want to purchase new LIC policy only for higher return only can u pl tell me which policy i should buy where return is the maximum among all policies. I can Premium for 16 years and monthly premium about 3000 per month and my age is 36

Amit-None of the LIC policies will generate you more than around 8% return in the long run. So my suggestion will be a big “NO”.

I have jeevan astha policy taken in Dec 2009 at the age of 32 for 5 years and sum assured was 25000.How much i will get on maturity.

Amit-If your Maturity Sum Assured is Rs.25,000 then Guaranteed Bonus on this for 5 years will be Rs.11,250 (Rs.90 per Rs.1,000 maturity sum assured per year for 5 year policy period)=Rs.36,250

Sir

what will be the loyalty bonus

Amit-Loyalty bonus is the one time payment payable during a time of claim of policy or on maturity.

sir,

I also have same policy but can you tell me how the loyalty amount calculated and what is its amount now on maturity of the policy as my policy get matured on 20 jan 2014

Mayur-Regarding valuations of your policy I suggest you to visit your nearest branch.

I have taken Jeevan Saral in name of my wife from April 2010.at the age of 30 for Death benefit of 500000.The per Month premium is 2042 for 25 years.can u tell me what will be the Maturity SUm assured

Amit-MSA will be Rs.7,09,840 and LA will be Rs.7,09,840 (LA @ Rs.1,000 per Rs.1,000 MSA)=Rs.14,19,680.

if I surrender this policy after completion of 5 years how much i will get

Amit-I don’t have data to say the values. Hence better to contact your nearest LIC branch.

Hi,

Has the bonus for 2013 been announced by LIC? Last year it was declared around this time of the year, so I was wondering if the same is announced this year too or not. I could not find anything on the LIC website.

Thanks,

Parthiv

Parthiv-No it is not yet declared.

Just got this information today, so it seems that bonus for 2013 is already declared..!!

http://www.investinsure.in/2013/09/bonus-rates-for-lic-jeevan-anand-plan-149-increased/

I don’t know how authentic this news is, but if it’s to be believed, bonus rate at least for Jeevan Anand has been increased. Don’t have information for other plans though..

Thanks,

Parthiv

Parthiv-Don’t know the source of this confirmation. I don’t have any data to confirm the same.

Here is the information for LIC bonus rates for 2013-14

http://iioe.files.wordpress.com/2013/09/bonus-rates.pdf

Thanks,

Parthiv

Parthiv-Thanks for your information. I will write the post on this.

mail me circular,my mail id is [email protected]

KK-Done.

Dear Sanjay,

I am Rajesh, I am in little bit confusion in taking policy. I am discribing it

below please suggest me which method is good for me.

Name: Rajesh.Ch

DOB: 26/05/1983

Method 1:

Policy: Jeevan Anand

Duration: 22 years

Sum Assured: 5,00,000/-

Premium Mode: Half Yearsly (Rs.12.467/-)

Now how much money I will receive after end of the polic.

As per my Lic agent, I will receive Rs.12,00,000/- after 22years.

Method 2:

Policy: Amulya Jeevan (Plant No:190)

Duration: 35 Years

Death Coverage: 25,00,000/-

Premium Mode: Half Yearly (Rs.4,947/-)

Along with Amulya Jeevan, if I invest Rs.15,000/- per year in PPF then how much I will get after 22 years.

Rajesh-1) If you go with Jeevan Anand then returns will be as below.

SA Rs.5,00,000+ Bonus Rs.5,17,000 (I considered current bonus rate for policies of term more than 20 years is Rs.47 per Rs.1,000 SA). So total you receive Rs.10,17,000. I don’t know how your agent calculated.

2) If you go with Amulya Jeevan then from your yearly budget of Rs.25,000 you need to set apart Rs.10,000 for this plan. Rest of the amount will be Rs.15,000. If we consider that you are contributing this as monthly Rs.1,250 before 5th date. Then maturity from PPF after 20 years (actual PPF period is 15 years but if we extend another one block of 5 years) will be Rs.7,00,377.

But do remember that while comparing both the products your SA are not equal. Also if you opt for some online Term Insurance products then they will be much cheaper than LIC’s offline term plan.

Dear Basunivesh,

Thanks for your reply. As per my LIC agent in jeevan anand policy FAB will be added at maturity time, as well as every 2 or 3 years bonus rates will be increased. So after maturity time I will get Rs.12,00,000/- as well as insurance will be covered for Rs.500000/- for normal death and Rs.10,00,000/- for accidental death up 70 years. Please let me know it is right information or not?

Please suggest which online term policy is good (with good settlement ratio) and please suggest which one is good form me i.e Jeevan anand or term+PPF.

Rajesh-FAB is negligible which will not affect that much return impact. So I will never consider that as a great differentiator. How he say that future bonus rates will increase? It depends on the performance of the LIC. So best option is to consider the current rate. Even if we consider also it will not make that much high return for you.

Go with HDFC Click2Protect. I suggest you Term+PPF is good.

Hi

sir please tell me about the final addition bonus rate of LIC jeevan Anand Policy all terms

Nidhi Kumar-As per the circular available with me, I didn’t find the FAB rate for Jeevan Anand. Contact your nearest LIC branch for the same.

Thank you.

I WANT TO KNOW ABOUT BONUS OF LIC CALCULATION IS IT SIMPLE OR COMPOUNDING.

Deepak-It is simple.

Hi Basu, from the link in lic website ( http://www.licindia.in/pages/BONUS_RATES2010_2011.pdf), can you tell me what should we understand on returns for jeevan shree policy ( plan 112 ) taken in jan 2002 and also komal jeevan ( plan 159 ) taken on Nov 30th 2010

Srinivas-For Jeevan Shree it indicates that for the policies if the term of the policy is 25 years and it comes to death claim how much one can receive the LA. For example for 25 years policy if death claim comes in the year of 19th then LA will be Rs.105 per Rs.1,000 SA. Same intreperation for the Komal Jeevan too.

With regard to Jeevan Tarang, can you clarify between Interim Bonus Rate, Assured Bonus Rate and Assured Step Up Rate? I am 37 years old and have a 15 year policy for 7.5 Lakh with yearly installment of 50,000. As per the policy, I will get 696000 after 15 years and 42,000 yearly there after. When are these bonus calculated?

Vik-With regard to Jeevan Tarang, I think you got the wrong information. There is nothing like interim bonus rate, assured bonus rate and assured step up rate attached to this plan. Please have a re-look at the information you got. This is the whole life plan. In this case if you survive till the policy period then you receive the accumulated bonus i.e. Rs.5, 17,500 (I considered current bonus trend of this plan which is Rs.46 per Rs.1,000 SA per year). So after this, you will receive 5.5% of SA life long.

I have purchased a marriage endowment/education annuity plan for 18 years and sum assured is 12l and my premium is 64k per annum

Can you please tell me what is my expected return for this policy

Enakshmi-Please let me know when you purchased this policy and the age at which you took this policy. Reason is, these are low yielding products. Even though you may feel Rs.12,00,000 will actually suffice for your kid’s education or marriage need, when you consider the inflated costs of both the expenses it is nothing but useless. Hence please provide the details I requested for.

Hi,

I have a clarification on the Jeevan Saral Policy. On the Bonus information sheet given by the LIC, on Jeevan saral, it has been mentioned that the bonus is 250 per thousand but it is only for the Death Benefit and not for the Maturity Benefit. Is there any maturity bonus available for the Policy Per year?

As i am having a 16 year policy, will i be getting any bonus.

Regards,

Vignesh. S

Vignesh-Yes you are right. But will they have any such rates for other policies where they mentioned in death claims they have different rate of bonus and for maturity claim they have different. I don’t think no. So we can presume the same bonus rate for both the cases. If you have doubt on my theory then let us wait until 2014 when Jeevan Saral 10 years term policy will come for maturity.

Hi,

I like to know some details on 2 plans as below. Can you please provide an approximate figure on the below plans.

1. New Jeevan Suraksha I

Term : 26 Years.

Premium : 50000

Mode : Yearly

I like to close the policy either 5th year or 10th year. Can you please provide me the sum that i will be receiving, if i close at 5th year and 10th year.

2. Jeevan Saral

Term : 16 Years.

Premium : 12130 (Total 24260 per year)

Mode : Half Yearly

I like to know the amount that i will be receiving if i close on 10th year and at maturity (16th year).

Also let me know, if jeevan ankur is a good policy in case of returns?

Regards,

Vignesh. S

Vignesh-1) For this particular policy returns you better to contact your nearest branch. Reason is, we can’t calculate the surrender value or paid up value on this platform. Hence request you to consult branch. I don’t know why you purchased this as the returns from such product is low (almost equal to inflation rate) and how can you be sustainable with such low return product after retirement.

2) Regarding Jeevan Saral, my recommendation will be to close if it already completed 5 policy years. Look at a few of the above comments. You clearly get an idea that this also belong to the lower yielding product (ranging from 5%-7%).

My advice to you is, first buy term plan based on your human life value, once you get it then cancel both the plans. Invest the left out amount in such a way that it needs to fulfill your financial goals. Hence first looking at product then planning your financial goal is not a wreath instead prioritize your financial goals then at the end select the suitable product.

Jeevan Ankur is the child insurance plan. In my view, insurance is mandatory when someone has financial dependents on him. Kid’s will not have any financial dependents instead we as a parent need to have insurance but not our kids. Hence treat the insurance as the risk mitigating product than the investment.

Hi Basavaraj,

Thank you for your reply. I just like to know a basic information of what i will receive, if close.

Is the LIC Branch, can provide me atleast an approximate value? If so, i will approach them soon.

Thank you.

Regards,

Vignesh. S

Vignesh-Yes they will provide you not the approximate but the exact details and they have to provide. So go ahead 🙂

suggest me some policy for children

Nidhi-It is not worth to consider policy (insurance) while you are planning for kids education and marriage. Hence my suggestion will be not to buy any insurance products which says child plans.

so where i invest for my child bright future, I want to buy Lic jeevan ankur for risk cover

Nidhi-First understand the concept of insurance. If something happens to me then my dependents like my wife and kids will suffer financially. But at the same time if something happens to my kid then me and my wife will not suffer financially. So insurance need to be on person who have dependents but not on others. Hence forget about insurance in your kid name. Instead cover yourself first fully. Once your insurance needs are over then plan on the goal.

Thank you Basu

Pleasure 🙂

my age is 35 years.i want to take lic jeevan saral plan for 15 years.what will be maturity sum assured and what will be loyality addition?

Pawan-May I know the reasons for opting this particular plan?

Hi Basavaraj…I was going through ur comments on various LIC products from last few months and I am really very convinced about ur knowledge on LIC products…so I have a query and I am sure u will be able to answer me correctly…I am 26 and I took LIC Jeevan Anand policy 3 years back for 27 years Sum assured Rs 10lakh so my policy will get matured when i will be 50years. now I am paying premium of approx 33000…what will be my approx return in that…kindly reply to [email protected] and also suggest me some policy for children both girl and boy and pension plan. Many thanks in advance

Ayush-Thanks for your comment. I will send my reply to your mail. Please check it.

Could you also send me a soft copy at [email protected]

Thanks

Prakash-Done.

Hi

I braught a LIC Jeevan Saral Policy (Table 165) for 15 years, Qterly premium 15312. Policy sum assured value 12,50,000/-. Please let me know my total maturity value.

Kowsar-Request you to raise this doubt by commenting on my new post title “LIC’s Jeevan Saral-Why so much confusion?“

I want t take a LIC Jeevan Saral Policy (Table 165) for 15 years, Qterly premium 6060. My age is 38 years. Please let us know my maturity value after 16 years. Please let us know also, the LIC Jeevan Saral Table is showing 884796/-. Is it true ?

Sharvan Kumar-Request you to raise this doubt by commenting on my new post title “LIC’s Jeevan Saral-Why so much confusion?“

I have bought a LIC Jeevan Saral Policy (Table 165) for 15 years, Qterly premium 6060. My age is 38 years. Please let us know my maturity value on 16 years. Please let us know also the LIC Jeevan Saral Table shown 884796/-. Is it true ?

Sir,I am 35 Years old, I have bought a policy LIC Jeevan Saral Qtrly 6030/- for 15 years, Please let us know my maturity value. The LIC Table show 8,88,794/-. Is it true ?

sir , i am babool looking for a lic plan , premiume among 30000-35000 for 16 yrs. my age is 25. so can u pls suggast a plan which is profitable for me and what is my return.

Babool-Sorry for the delayed reply. May I know the reason for looking LIC plans specifically? Can you elaborate on this?

Yes basu i know return is not true,so i want to know exactly how much amount after 10 year in 2021 or suggest me should be canceled or switch to jeevan anand everbody said jeevan anand is very good policy and give an extra return.

Please give me some suggestion

Rahul-I am extremely sorry for missing to reply to your comment. To calculate the exact return of Jeevan Saral I need your age too. Because maturity sum assured depends on age factor. Roughly we can say that returns for 10 yrs policy will be around 4-5%. Now switching to Jeevan Anand, it is like switching to another mistake to avoid one mistake. Features are bit different and may looks attractive. But returns from this policy too hover around 6-8%. Hence please ignore both the plans and stick to term plan and need based investment rather than fulfilling your agent’s dream.

Hello basu ,

i buy a policy of jeevan saral premium of 6000 per month for 10 years they said after that you got 7.5 lakh it is true?and when i said to agent they show a one table n which mention that after 10 year got a 7.5 lakh.If it is not true so please send me all bonus details after 10 years what you expect and snd me brouchure also in which all details mention reagarding this policy.Please basu…[email protected]

Rahul-You are paying Rs.72,000 annually means total you pay Rs.7,20,000 in that 10 yrs of policy period. So what you agent’s quoted amount of Rs.7,50,000 is apart from what you paid or just you will receive Rs.7,50,000 only? Please clarify about the same. Once you give me a clear picture what your agent told then I may in a better position to say you whether he is saying right or wrong.

Please look at above comments and you will find that for 10 yrs policy and considering the current LA declared by LIC, you may expect hardly around 4% return. So first share your agent’s claim then I will definitely guide you on this issue. Also in the mean time please refer above comments on Jeevan Saral plan.

Hello basu sorry wrong written ,they said after 10 month you got a 15 lakh rupees just approx double an amount..when i consult again they show me a table no 165 of jeevan saral and said that is generated by LIC team.If you go and consult in lic office ,in that also same table.So i wantto know exactly it is true that shown by an agent table 165 for jeevan saral

Rahul-This is how they fool you. It is the mandatory indicative return which either LIC or any other insurance company will show you according to IRDA rule. But it does not mean that they will definitely give you that much return. It is just for illustration purpose. Hence ask your agent if LIC pay that much then will he pay you back you? Ask him from written 🙂

Sir if I take jeevan anand policy for 21 years of 10 Lakhs

How much lump sump amount i will get after 21 years at present rate………….

Rajkumarmeena-Return after 21 years will be Rs.10,00,000 (SA)+Bonus Rs.9,87,000 (I considered the current bonus rates which for 21 yrs policy will be Rs.47 per Rs.1,000 SA)=Rs.19,87,000.

sir pls send me the circular of jeevan saral bonus to me

my mail id is [email protected]

Rajkumarmeena-For your information Jeevan Saral will not have bonus instead it only contains LA which I shown in above table.

Hi,

I did a LIC endowment policy (table no 14) in 2006/07 for 25 years (my age then around 30) for a SA of 25 lakhs for 25 years. Any idea what will be the final maturity value going by the current trends?

Thanks,Sam

Sam-In your case returns will be Rs.25,00,000 (SA)+Rs.30,00,000 Bonus (I considered today’s trend which for 25 yrs policy is Rs.48 per Rs.1,000 SA)=Rs.55,00,000. I have not considered Final Additional Bonus as it is one time payment and you will receive at end for being loyal with LIC.

Thanks Basu. Whats the range in which FAB can be expected as a percentage of SA for my scheme?

Sam

Basu: can you suggest any good child plan to me @[email protected]?

Ritesh-Best plan is, take term insurance on your life first. Then based on your kid’s age start investing. Suppose your kid’s education or marriage goals are more than 10 years then better to start investing in well diversified equity mutual funds. Don’t go to any plan where returns and insurance coverage will also not suffice. Let me know if you have still doubts.

PPF is the best in debt category as of now..(Till gov does not slash the rates)….but those who have already burnt their fingers in LIC should atleast wait for 5 yrs to get back their hard-earned money….I will be going to LIC branch to check if reduced premium will be done after 3 yrs or making policy paid-up will help…Then i will take a call….or may be i can divert the money left to PPF and gain max interest…Thanks basu for the insights…

Sushila-You can also play with debt funds now as everyone is expecting a rate cut from RBI. Wonderful decision what you have taken. Best of luck 🙂

what is bonus for bima gold please

Baskaran-For your information Bima Gold does not have bonus instead it only contains LA.

Thnks Basu, U are right that LIC treats 5yrs paid policy like original term…one gets MSA but not LA…LA is only after 10 yrs….However, I am planning to decrease premium so that I keep the dscipline of investing regularly (that is only thing i like abt LIC)…one becomes desciplined…though SIP in equity is also gud…but there ur fingers are always crossed bcoz noone is sure where the market will go….ur money r always at stake….in debt category, lic policy is gud…although ppf may be great but due to non-compulsion of premium, i become lazy to invest in that..Lastly, i am loving ur site…u r doing great job…keep going.

Sushila-SIP is the tool used to mitigate the risk of equity market over the longer period of time. You feel fingers crossed when you check your investment on daily when your financial goals are of long term. It does not mean that we can’t review. But once in a year review and re-balancing is good habit. You are rightly told about LIC policies, you need to consider them equal to your debt portion of portfolio. But in my view PPF works wonders than these LIC policies. Let me know your views. Thanks for appreciating about my site 🙂

Thanks Basu for your suggestion….But after 5 yrs, will i get 90% of the premiums paid till 5 yrs(excluding 1st yr premiums) or anything more than that???? or the last choice i am thinking of decreasing the premium amt(from 15K Qtly to 5K Qtly) and continue paying for 20Yrs…..atleast though less but chances is i will min earn 6%…..what u say??

Sushila-If you complete 5 policy years then in Jeevan Saral term is treated as 5 yrs policy only not the original term (in your case 20 yrs). Hence after completion you will receive 5 yrs MSA (which is based on your age and premium you paid)+LA. So instead of decreasing premium and go on investing for remaining years, this suites best for me. Let me know your views too.

Hi Basu, Your chart is very helpful. My husband had bought Jeevan saral in Mar 2011. We r paying Rs. 15213/ Quaterly (SA Rs. 12.5 L for 20 yrs). 9 premiums has been paid till date. Please suggest if we should surrender or get it paid – up after 3 yrs.

Sushila-If you surrender now then you may end up in facing loss. Hence better to complete 5 years then opt for surrender.

hi,

can u send me bonus circular for LIC on [email protected]

thanks in advance

Shree-Done.

Sir i want intrest take jeevan saral policy with 1500/month for 15 years term.im using the premiam caliculator to caliculate my monthly premiam it can shows SA 400000, sir i have a big dought this 4 lakhs SA is only for risk cover of policeholder?after end of 15 y term how much of total maturitry amount i will get?

Sir small correction my monthly premiam is 1600/m 15 y term.

Srinivas-Yes your doubt is correct, SA is for life risk. Please go through the above comments, you will come to know what you can expect from this policy.

Just wanted to know whether jeevan saral return will be around 9% return after 35 years investment… what u think

Rajesh-It may be. But not sure….:)

postal life insurance is better than LIC.Because PLI offers bonus of rupees 70 per thousand in endowment scheme and 90 rs for wholelife insurance.

Makesh-It is true that postal insurance offers higher bonus rates than LIC and premium is also less, but only employees of below mentioned organizations are eligible. Then what about the rest?

Employees of Central Government, Defence Services, Para Military forces, State Government, Local Bodies, Government-aided Educational Institutions, Reserve Bank of India, Public Sector Undertakings, Financial Institutions, Nationalized Banks, Autonomous Bodies, Extra Departmental Agents in Department of Posts.

Hello Basu,

I have taken jeevan Jeevan Anand for S.A 5Lakh, for 25 year My age is 29 year what is the Maturity Amount after 25 year Please tell me.

Thanks

Nidhi Kumar-If we consider the current bonus trend for future too then the total Bonus accumulation will be Rs.5,62,500+Sum Assured Rs.5,00,000=10,62,500. Final Additional Bonus is also their but it will be less than Rs.30,00,000 in my view hence I neglected that part for calculation.

Thank you Basu..

How i calculate the Final Additional Bonus

Nidhi-FAB is one time payment which you age at the end of term. Usually it depends on the term you opted. So if LIC declares Rs.200 (for example purpose I mentioned this amount, dont think that this is the true FAB) as FAB for 25 years or more term policies, it means that for Rs.1,000 Sum Assured they will give you Rs.200 as FAB. If you multiply this with your opted sum assured then you get the FAB you will get.

Hello Basu,

Please help me I have a Jeevan Saral policy of Rs 60000 per annum for 20 year.I have payed 1st year premium.As per your article it will give me around 3.5-4.5% return after maturity.Should I continue with this policy or just canceled it now.Please advice me…

Monojit-For 20 years this policy may give you around 8% return not 3-4% (this return is for 10 year policy). Decision is now depends on you to continue or not. In my view if you really paid one premium then better to cancel immediately. But you will not get any money back. If you want some returns then need to continue for atleast 5 years. Then surrender it.

Thank you Basu..

But If I continue this policy till 5 year then how much money will I return back? should this more beneficial than today’s loss of 60000..

Manojit-In my view it is just a relief that at last you got your invested amount. So instead of loosing Rs.60,000 now it is better to continue till 5 yrs and get some money with little bit of smile 🙂

Hi Basu,

Can you please send me the soft copy of LIC circular ([email protected])?

I have enrolled for Jeevan Saral (Rs 5000 PM for 35 year with DAB). Assuming, I surrender my policy after 20 years, what is the LA which I can expect?(The table is for 10 and 11 years only)

Thanks, gautam

Gautam-I will send the soft copy of LIC circular. Please look at above comments, I did the calculation for similar few of doubts.

Sir, i have taken policy Jeevan Saral yearly plan of amount 18015 per year for 20 yrs. Agent told that can also withdral after 16 year. So, Plz. tell me maturity amount on both cases.If possible then plz. send soft copy of LIC calculator([email protected]). Thank u

Vijay-Their are plenty of calculations I did for the term of 15 and 20 years. Please go through above comments. If you still not catch the points then let me know, will definitely do the calculation and help you. I don’t have any readymade calculator for calculating Jeevan Saral returns.

Sir I want to By a policy from LIC for my mother, who is 53 years old now. So, please suggest a best policy for her. \

Premium should be 8000 to 10000

Pratyusha-First of all please let me know why you want insurance coverage for your mother who is 53 year old? Someone depend on her income? Is she generating income? If yes then I may suggest you the ways. If no, then my suggestion is a big no for buying insurance.

Basu, Thanks. I do have a employee cover both on Life as well as mediclaim, however, I have always been an advocate of the same theory as what has been advocated by you and hence have separate covers by self. Currently, my daughter is covered under my mediclaim and I want to explore the possibility of moving away from my cover to cover under her name for all of us. If that is not possible, would look at a separate cover for herself and remove her cover from my policy. All of this is being planned from Taxation and long term savings on cost of insurance perspective. Please advice.

Ashit-Better to take her separate health cover. That seems good idea. Whatever you shared looks fine for me. So go ahead. I didn’t understand this line “All of this is being planned from Taxation and long term savings on cost of insurance perspective”, can you elaborate on this? What type of further advice you are expecting from me?

Basu,

Presuming i & my wife survive till 75 yrs of age. We both are currently 46 & 45, we hv 35 yrears to go. If i continue my current policy, I would start shelling out additional premium fue to change in age bracket. But if i move to a separate policy for my daughter and cover myself & my wife as her dependants, then, may be there might be some saving of premium to be paid as compared to the current situation? Am not too sure of what my understanding on this is. If you could clarify more elaborately on the same. Further, since the policy would be in my daughters name, she would get the tax benefit on the sane. A small catch here is the fact that i still have a younger daughter who needs to get covered too, again, the presumption is that she coukd be termed as dependant on her elder sibling.

Please clarify based on above.

Ashit-Your understanding about premium is correct. But to be frank when you are taking family floater, premium will be fixed based on the eldest member of the family but not on the youngest. Hence in my view you will not get that benefit. I come to know about only one policy from National Insurance which offers only to Bajaj Capital clients, where the proposer’s age is considered instead of family’s eldest person age. But the trick is, you need to be Bajaj Capital investor, means you need to invest something. So it is again indirectly cost you more. Hence in my view, as your daughter I think is major so better to separate her from your membership. Continue you existing insurance with inclusion of your younger daughter. In this way, your elder daughter can be independent even after marriage too. But still you have doubt on this then better to contact exclusive health insurance expert Medimanage. Click here to view their contact details. They will guide you in a better and unbiased manner. If you still face problem then let me know.

Hi Basu,

Have gone thru the thread above, have a question on what is the approx maturity value for Jeevan Mitra (Double Cover Endowment Plan) i.e. plan 88/25/25 where premium paying is till 25 yrs and the last premium has been paid on 18/11/2012, maturity date is 18/11/2013, sum assured is for Rs. 1 lac. Also, what is the approx maturity value of The Endowment Assurance Policy i.e Plan 14/24/24, where the last premium has been paid on 02/05/2012 and the policy is due on 02/05/2013, sum assured is Rs. 25,000/-. Please write back to me on [email protected]

Ashit-It is cumbersome for me to track all those 25 yrs bonus rates for Jeevan Mitra and 24 yrs for Endowment plans. Anyhow you paid all premiums and the only option left for you is to wait till maturity period and and cash it. If you really so nervous about the returns then contact your nearest branch they will help you out. From both the policies you may get around Rs.2,50,000 (it is my assumption). Hope this may be your 6 months household expenses. You bought them 25 years back thinking that this Rs.1,00,000 and Rs.25,000 are more valuable by ignoring the inflation values.

Hi Basu,

Thanks for the reply. Will try to get details from the nearest LIC office.

Also, if its 2.5 lacs as stated by you, it would be close to 8 months of my monthly household expenses.

Ashit-Pleasure 🙂 Hope in future investment you will also consider the fact of inflation before investing. Happy Investment 🙂

Hi Basu,

This were investments initiated by my father & Father-in-law at an early stage of the start ofmy professional journey and when they did not have the option of seggregating investment from risk cover. All my current covers are term plans and am covered to the tune of Rs. 1 crore under life, 1.1 crore under accident cover.

I intend to initiate a life cover as well as mediclaim cover & accidental death cover for my daughter who is persuing her articleship under the CA course. Her current annual earnings is in the range of 2 lacs annually. Rqst some suggestions on the options available.

Ashit-Sorry for misunderstanding about your past investments. Follow the same plan for your daughter too like what you did for yourself. Take Term Plan to the tune of 10-12 times of her current earnings and increase it after every 2-3 yrs in the proportion of her income and liability. Accidental cover and health cover best to buy now itself as they cost less to her age (few depends on employer health cover, but always better have your own health insurance). Include critical illness cover also for you and your daughter. If this much is done then I think insurance part is almost fulfilled. Please let me know your thoughts too.

Hi,

we have taken jeevan saral for 4000 and 6000.Its for 16 years term.

But MSA mentioned are 831440 and 1226880 respectively.Although we were told by agent that we wil get around 50lakh.

What are we missing?

Shikha-Please share the age at which you took these policies. Because MSA depends on age too.

BasuNivesh, My age was 31 in 2011 when I entered this policy

Shikha-Considering your premiums as monthly, what your agent told about MSA are true. But let us consider the LA which is additional benefit you get with MSA are currently Rs.250 and Rs.300 for each Rs.1,000 MSA of 10 and 11 yrs policies respectively. So if we consider the same trend of LA rates for 16 yrs policies, then we may consider LA rates as Rs.550. But to expect higher returns we can consider Rs.700. In such a case for the first policy your LA will be (where your premium is Rs.4,000) Rs.5,82,008 and for another policy (where your premium is Rs.6,000) Rs.8,58,816. So from both the policies you will get around Rs.34,99,144 [(MSA Rs.8,31,440+Rs.12,26,880)+(LA Rs.5,82,008+Rs.8,58,816)]. Return on investment is around 7%. If you opted for PPF for the same amount then your returns after 15 years will be Rs.41,01,842.

If we go according to your agent then the return on investment will be 10.61%, which is highly impossible by the way the expenses are attached with it. (I am considering only agents commission which is 35% in first year, 7.5% in 2nd and 3rd yrs and 5% for the rest of the period). Now think and decide.

i want to buy komal jeevan plan for my 2 y baby is it best plan or is there any other good plan in lic if i buy for 2 lac how much value i receive for 2 lac

Rupinder-Eventhough in this plan you are assured of Guaranteed bonus rates, but premium is high. So if you calculate overall return then it will fall within range of 6-8%. Hence if you are planning for your kid’s future, then better to opt for equity investment with mutual fund route. Let me know your views too.

sir, plz explain in detail if premium is high for komal jeevan plan than plz sugest any other plan in lic

Rupinder-As told above by Manish, it is always better to separate your investments with insurance. Hence to cover your life risk, first take term insurance to the tune of 10-12 times of your yearly income. Rest of the amount diversify your investment into Equity, Debt, Gold or any other available options according to your risk appetite. In my view your goal is long term (which I think 16-20 years away from now as you told your baby’s age is 2 years), so go for equity mutual fund option around 90% and Gold 10%.

sir how i calculate maturity value for lic plan i want to understand how to calculate final value from LA and bonus

Rupinder-Please look at my reply to Preeti.

hello sir plz tell me how i calculate maturity value of lic plans if i want to buy how bonus and LA make maturity value

iam planing to buy komal jeevan for m 2 y baby for 2 lac send me at [email protected]

Preeti-Bonus calculation is usually per Rs.1,000 Sum Assured you chosen. So suppose if a plan have bonus of Rs.50 per Rs.1,000 Sum Assured per year, then if your Sum Assured is Rs.5,00,000, in that case you will get (Rs.5,00,000*50)/1,000 which is Rs.25,000 will be your earning from this policy per year. But this you will get on maturity. Also remember that this bonus rates changes every year. So never assume that the same will apply for future too. LA-It is calculated in the same way as of Bonus but it will be paid only once on maturity. Hence bonus is yearly return but LA will be one time return and you get both at the end of policy or in case of death claims. Hope you understood what I described. If you have still doubt then you can raise it.

i want to invest in jeewan saral plan my age is 34 i think 20000per year for 20 years can you tell me how much amount i will receive after 20years

Sumit-Please refer above comments. You will get a better idea.

Mr Rupinder,

Do not mix insurance with investment,just buy a term insurance and invest reamining amount of your premium payable amount in good balanced and equity diversified funds. Returns will be much higher and tex free too.

Basu,,, last time… we commented on jeevab saral….i remembered u told me ki,,u had same policy against ur name

Ur plan of action,, what are u thinking … to terminate it or continue???

Nagaraj-We might, but I never told anywhere that I have that policy. I might have told about wholelife policy but not about Saral.

DO U ADVICE TO CONTINUE WITH JIVAN SARAL PLAN , HOW MUCH IS SURRENDER VALUE AFTER 4 YEARS , PARTIAL WIDRAWAL IS AVAILABLE ?

Pravinkumar-Continuation decision entirely depends on you. Look at above comments, if you are ok with the kind of return this policy may generate then continue. Instead of surrendering the policy after 4 years, it is better to surrender after 5 years.

Hello Basu Sir. how r u? can u pls send me the bonus & loyalty rate circular of 2012 on [email protected]…….

Regards

Poonam Chudasama.

Poonam-Done.

Hi Basu,

Hope you are doing well. Please suggest if its correct or not:

My Friends Cousin who is an LIC agent suggested him LIC table No.186 Jeevan Amrit Sum assure 1000000 Term 15years premium paying term 5years total premium in 5 years would be 1,10,000. On maturity he will receive 30 (revisionary bonus)x15 years x 1000= 450000+110000=560000. In case, this is not true than how should the maturity be calculated in this policy and how much return he will get actually get at maturity as per current bonus rate.What is current FAB on This Policy.

Your response would be highly appreciated.

Regards,

Aalok

Aalok-Sorry for delayed reply. As you not mentioned your age, I took the example of 25 yrs old guy who is looking to buy the above plan. For him considering above data, premium will come Rs.57,079 for first year and for the next four years it is yearly Rs.14,282. So overall you are paying is Rs.1,14,207.

In Jeevan Amirt plan on maturity you will get Total Premium you paid+Revisionary Bonus+FAB (If declared by LIC). So if we consider the same bonus rate then for total 15 years bonus will be Rs.4,50,000. So total you get around Rs.4,50,000+Rs.1,14,207+ FAB if any (which is usually in thousands, hence I neglected)=Rs.5,64,207. Return on investment is 12%. But dont think this bonus is fixed it fluctuate on yearly base. Also think whether the said life risk is sufficient to cover your financial liabilities if something happens to you. Currently I dont have any idea about FAB of this policy. If they declare too it is negligible (in thousands).

Hi basu,

i am R.Ramakrishna age 28 now. I have done jeevan sarala policy in 2012. I am paying 24000/- per year.Can u tell me how much i will get after 10 years i.e. in 2022 if i surrender .

Ramakrishna-Request you go through above comments. I did calculation.

Hi Basu, can you send the circular for Jeevan Shree to [email protected]

Mathew-What circular you want?

Hi Basu,

My friend’s DOB is 19-12-1983, he wants to pay 34-40K every year for 10 years and wants Pension from 60 years to 100 🙁

please let me know any good LIC Plan.

Mahesh-I need few more data like his current household expenses and his lifestyle he want to maintain at the time of retirement. Also why you are asking on behalf of your friend? Let him come forward share his doubt. I will definitely help him. Please do share those details to my official mail id.

Sure , i will ask him to send u the details..

Mahesh-Thanks

Very Nice Article, Can you send me the email of the bonus as it is still not on the LIC website.

Thanks

ritesh

[email protected]

Ritesh-Thanks and will send the circular.

Hi basu,

Can you please mail me the chart. I am not able to understand how to calculate LA and MSA. My policy details are–

policy name : jeevan saral.

policy term : 16 years.

Yearly instalment : Rs 48040.

Can you tell me how to calculate the complete amount which i would be getting after 16 years? I went thru the comments but didnt get how to calculate the amount at maturity. Are BONUS and LA different things?? Lets consider the interest rate to be 5 percent. Is this feasible ?? Please tell how to calculate BONUS and LA.

Email id- [email protected].

Thanks

Nikhil.

Nikhil-MSA of Jeevan Saral is available with any agents. So for the particular age, premium payment and tenure of the policy, you easily get it MSA. In Jeevan Saral LA will be additional benefit which you get over and above MSA. This LA is currently declared for 10th and 11 yrs policies. So considering the same trend of LA we can assume the returns on your 16 yrs policy will be around 6-8%. Calculation of LA was done on the same base, which you can see from above comments. Yes, bonus and LA is differ. For Jeevan Saral their is no bonus but only LA which is one time payout where as bonus will be added to your policy whenever insurer declares (normally yearly). Regarding the feasibility of 5% interest, it is achievable easily as you can expect around 6-8% from this policy. But will it be feasible to have such low returns to meet your financial goals over the period of 16 yrs? Certainly not. Think and decide.

Thanks. Indeed not a good choice. But how did you calculate LA? I didnt get that. Can you please calculate LA for me for the details provided sir? Lets say the interest is 6%.

Thank you.

Nikhil-Hope yesterday’s Facebook chat cleared your all doubts.

dear,basu,

plz explain about both…

Bijay-Don’t be generic. Set your financial goals today and based on that it is better to plan your investment. It is not wise to take the risk for your short term goal and in the same way it is not prudent to put all your money into safe investments for long term goals. Hence if you share your financial goals, current investment and your cash flows then I am in a better position to share the ideas.

HI , I found this page quite interesting as just last year someone told me about this Jeevan saral and showed me that chart with 10% calculation. I also invested around 1,00,000 ( 1 Lac) each year and I have taken it for 30 years.Can you please suggest connsidering my age as 30 Years as of today , what will be the Maturity Sum Assured after 11 years for me ?

Please provide your valuable inputs so I will plan to drop this policy after 5 years if gain is not there

Nitin-What your agent showed of 10% return is illustrative example to show the benefit of plan. This is mandatory as per IRDA to show both 6% and 10% return benefit. But it does not mean that it will generate 10% return. In all probability if we calculate considering the current trend of LA, we can presume that it will give you around 6-8% return. Hence it is better to stop it after 5 years.

for secure life also tax benefits

Bijay-Wonderful reply. For your information high return is always directly proportional to high risk. In one way you are saying secure life but in above comment you are asking for high return. Please be specific whether you want high return or secure return??

Dear Basuji, Thanks for the prompt reply. I forgot to mention that i already have a term plan from LIC Jeevan Amirt for a good amount and the term selected was 30 and ppt was 3 years. then i thought that this will be finished after 30 years so took whole life policy table 8 single premium.

I already have term plan then also u suggest me to surrender whole life policy and take another term plan.

Regards,

Abraham

Abraham-Thanks for sharing. For your information, Jeevan Amrit is not the pure term plan product. This is the plan where initial chosen (3rd, 4th or 5th) years premium will be higher and subsequently premium goes down till the maturity period. This is again a combination of insurance+investment product. Please think yourself, the sum assured you chosen (you mentioned good amount now, but will it be good amount after 30 years??) will cover your family to the next 10-12 years without any financial burden in the event of your death? This is the traditional plan, so returns will be around 6-8%. Will you be able to beat the inflation by such kind of low yielding product? I am not saying this plan is bad. But it is not wise to invest major portion of your portfolio. You need to treat this product as if debt investment.

Hello Basuji,

I was lucky enough to read your valuable comments provided to various readers. I would like to ask your opinion on my two policies.

1) Jeevan Shree – 1 SA is 700000 and PPT is 8 years for policy term of 25 years, i just want to know that this policy is 3 years old can i avail a loan from it, if yes then what will be approx loan amount. I understand that current LIC rate of int is 10%.

2) I have taken a Whole life policy single premium for the SA of 500000 just 6 months back. Now i regret this dicision or shall i surrender this policy or invested that money in some debt instrument.

Regards,

Abraham

Abraham-Thanks for your kind words.

1) Yes you can avail loan from this policy. But regarding the exact amount of loan availability, it is better to contact your nearest or servicing branch.

2) Please request you to surrender immediately and take term plan to cover your life risk first then invest the rest of the amount according to your goal and risk appetite.

hi,BASU…i want 2 do a policy of sum assured 5 lacs…plz sugest a high return policy…

my age is 31

Bijay-May I know the reason of opting Rs.5,00,000 sum assured?

Hello,

I have taken policy Table no. 14 in the year 2004 for 10 years & last premium of Rs. 7821 is due in March, 2013

Tenure 10 years, premium 7821 per year, sum assured 75000

what will be maturity value in 2014 ?

Rajesh-You will get Sum Assured (Rs.75,000)+Bonus (Rs.25,500-Calculated considering bonus rates which is Rs.34 per Rs.1,000 Sum Assured policies whose term is less than 11 years)=Total amount you get is Rs.1,00,500. Return on investment will be 5.45%

Thanks bishu……..but i want to know that in above table you mention only bonus rate for jeevan anand didnot mention la for jeevan anand?.

I have already did a one policy that is jeevan saral and when i read your comments then feel it not give a gud return when i visit to any agent everybody said that jeevan anand is best that jeevan sarl becoz jeevan anand give all three (FBA+Bonus+LA) and jeevan saral give only (LA) but i note in above bonus rate in Jeevan saral LA is 250 or 300.

So is it right?in jeevan anand how much la give after maturity?on basis of assumption.

rahul

Rahul-Thats what I told. Each policy’s premium, features and returns differ. For your information, Jeevan Anand have only Bonus+FAB but it not contains LA. Even if it have also, it is impractical to compare product by Bonus+LA+FBA is good than product only have LA. What if the declared bonus and fab are not on higher side than Jeevan Saral’s LA? Hence dont go only by looking at what additions they are offering with normal bonus like FAB or LA but look at your need…especially insurance need. Will it cover your insurance need is the first question you need to ask yourself. For how many years your dependents survive on this claim amount if something happens to you? Think and decide 🙂

thanks basu again for guiding me…….yes u right,actually i am luking towards growth oriented plan thats why……

so please suggest me i have planned to add a term plan and also wantto invest in ELSS through SIP.so please can you suggest me which is suitable for me or wait for next financial year starting??

And i have already invest Rs 6000 in jeevan saral for 20 years so till 2022 can we expect a good LA by LIC?what u think abut it?All lic agent shows a 10 % return ,thats why i bound in that policy…..and so much fear about its return.If return is not gud then again i need to think abut my portfolio.

Rahul

Rahul-You send me your personal queries to my mail by sharing details like your age, current financial status like income, expenditure, loans and current savings. Then only I am in a better position to guide you. This platform is not suitable for specific financial planning.

Hi Basu,

Do we get FAB for table 14 for 16 years term SA is 6Lakhs,

i am paying 37067/- per annum i have taken policy for 16 years and my dob is 11-04-1984.How much i could get after 16 years.

My Agent told me that i will get 17+ lakhs after 16 years.

Is this true ?

Please suggest me.

Mahesh-Yes you will get FAB for Table No.14 for 16 years of term (if premiums are paid more than 16 years). Returns from this policy can be calculated as below.

You get Sum Assured+Bonus+FAB at maturity. Currently bonus rate for this policy for 16 yrs term is Rs.42 per Rs.1,000 Sum Assured. If we consider the same trend for our future calculation then total bonus you get from this policy will be Rs.4,03,200. FAB as of now is Rs.25 per Rs.1,000 Sum Assured which is one time payment. Hence FAB will be Rs.15,000. Hence you will get around Rs.10,18,200. Return on investment will be 6.81%. Less than normal PPF investment 🙂

If we consider the returns what your agent quoted then it will be 12.80%. If he is so confident and ready to give me the assurance with some valid proof either from LIC or from him, then I request you to tell him to contact me. I am ready to invest and ready to give good number of business. Which ultimately makes him crorepati 🙂

Hi Basu,

I want to ask that in jeevan anand policy shows a fab+bonus+la .but in jeevan saral only la

So if we assume LIC give a equal output in each policy then we can assume that Jeevan anand output(fab+bonus+la) is equal to jeevan saral(la).

And i have noticed in above la in jeevan saral is far more and more from other policy.

Actually what it is?can you please help me to understand this.

Rahul

Rahul-Each policy’s features and return differs. You can compare for your calculation. Hence for Jeevan Anand it is FAB+Bonus+LA is depend on that plan feature which you can’t say why not with Jeevan Saral. LIC will not give equal output to all policies, it depend on how much they generate from the accumulated amount from each policies. I did not get your point “And i have noticed in above la in jeevan saral is far more and more from other policy.”. Features of Jeevan Saral is different with Jeevan Anand. Hence look at it’s features and return then if it suites you then only better to go for any product.

Hi Basu,

I have LIC Jeevan Shree (T.No # 112) which I have taken in Jan 2002 with 5,00,000 Sum assured.Could you please let me know approx maturity amount ?

Policy Term : 25

Premium : 24,593

Thanks for your help,

Karthik