From today onward each mutual fund product bears one color code beside it. This is specifically designed for easy understanding of the product and the risk involved in each product. Let us see what each colour indicates.

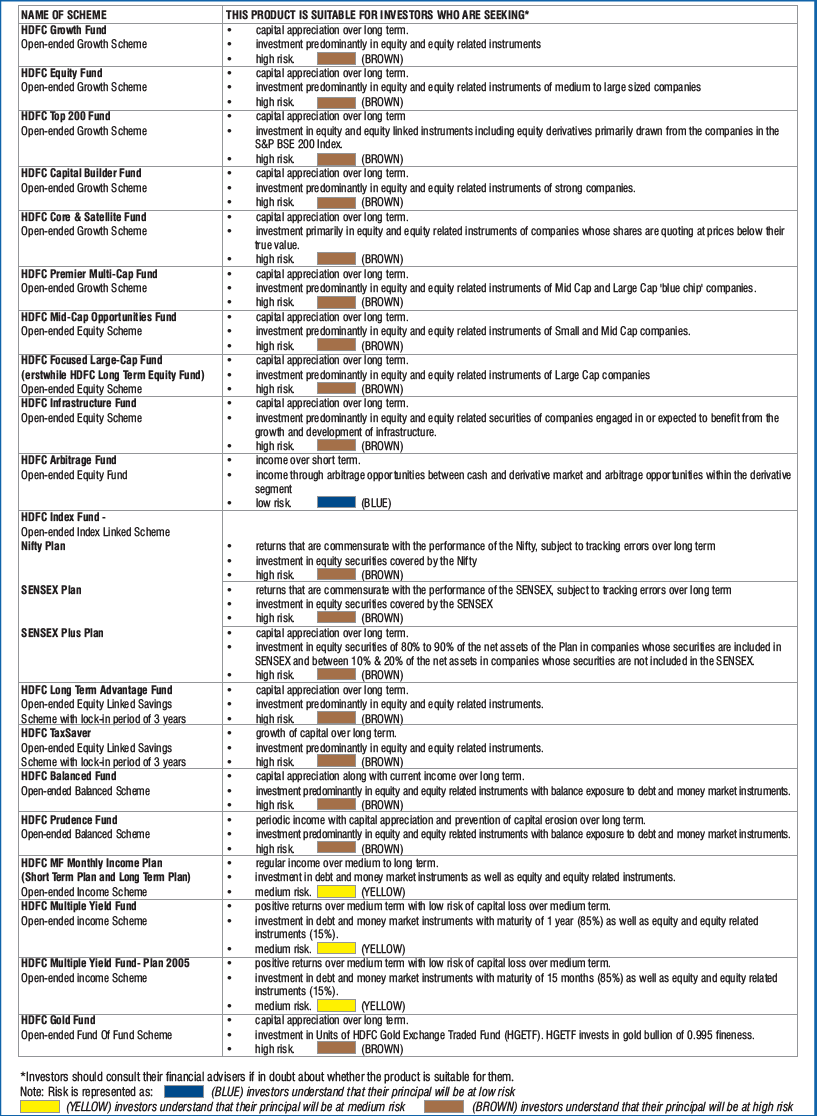

All mutual fund schemes are divided into three categories based on the risk involved in them. Colour codes will have to be displayed on the front page of the application forms, next to the name of the scheme. They are as below.

1) Mutual Fund Colour Code Blue-This colour code indicates low risk. Funds such as liquid, gilt or income funds carry this colour code. These products are ideal for the investors who are looking for safety of their investments.

2) Mutual Fund Colour Code Yellow-Schemes which aim to generate capital appreciation and income will bear yellow colour. Funds such as MIPs, hybrid funds or balanced funds will come under this category. Such funds are ideal for investors who are looking for diversification in their portfolio between equity and debt.

3) Mutual Fund Colour Code Brown-All equity funds irrespective of the theme will come under this colour code. So all large cap, large and mid cap, mid cap funds, small cap funds, sectoral funds or index funds will come under this colour code. Investors who are looking at capital appreciation over a longer period with taking risk are ideal to choose such products.

Below are the two screen shots of HDFC Mutual Fund company from where you can identify these color codes with respect to each fund.

But the big question will this really make investors knowledgeable in selecting the funds according to their choice? A Big no….

Reason is, each mutual fund company have plenty of schemes and categorizing them within these three mere colours is a bit generic. It is as if you are differentiating all living things like human with blue colour, animals with brown and plants with yellow. Each fund has its own investing goal so it is I think a wrong decision which automatically sometimes make investors in doing wrong choice.

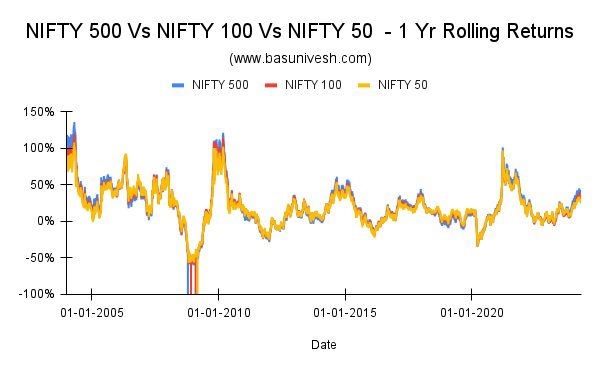

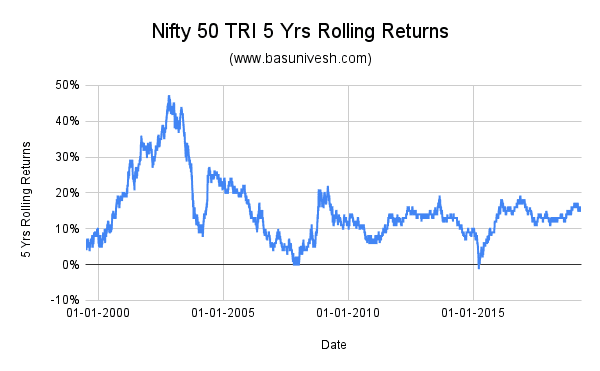

To see specifically how this impact, let us take examples. All risky funds are now coloured as brown. But actually here index funds are at lower risk than small or mid cap funds. This will not specify the difference if you only select the funds based on colour. At the same time balanced funds and MIPs constitute different equity exposure but are kept in same colour code. Also no difference between liquid fund or gilt fund in low risk colour code. So overall it looks too generic classification of funds.

Also few investors by looking at colour code may totally stay away from equity investment as the brown colour resembles their principal at risk.

4 Responses

Hi,

I have received some lump-sum amount from risk free asset. I want to reinvest it in risk free asset class for period of 8 to 10 years. What would be your advise on this investment?

Thanks in advance.

—

Mital.

Mital-Please elaborate more about your understanding of RISK FREE.

Risk free means non equity (avoiding highest risk investment asset class).

Mital-Bank FDs but ready to scarify the return due to inflation.