On 9th May 2015, Government of India launched one more scheme called Atal Pension Yojna (APY). This scheme launched along with Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY). I already covered both the schemes in my earlier post. Now in this post I try to concentrate on Atal Pension Yojna.

Latest Post–Difference between New Pension Scheme (NPS) and Atal Pension Yojana (APY)

Latest Updates (20th August, 2015)-Government modified some rules of APY. They are as below.

- Now instead of only monthly payment option, subscribers can invest like monthly, quarterly, half-yearly or yearly.

- The account will not be deactivated and closed till the account balance with self-contributions minus the government co-contributions become zero due to deduction of account maintenance charges and fees.

- The penalty on delayed payment has been also simplified to Rs 1 per month for a contribution of Rs 100 for each delayed monthly payment instead of different slabs given earlier.

- Premature withdrawal now be possible with some conditions. The subscriber will only be refunded the contributions made by him to APY, along with the net actual interest earned on his contributions.

Few more changes via notification dated 29th April, 2016 is as below.

Option to the spouse of the subscriber to continue contribution to APY on death of subscriber before the age of 60 years:

“If the subscriber dies before the age of 60 years, his/her spouse would be given an option to continue contributing to APY account of the subscriber, which can be maintained in the spouse’s name, for the renaming vesting period, till the original subscriber would have attained the age of 60 years. The spouse of the subscriber shall be entitled to receive the same pension amount as that of the subscriber until the death of the spouse”.

Retirement planning is one of the most important goals of Financial Planning. However, sadly only a few individuals plan for it. The reasons are many. Two main reasons for this are-Negligence and unavailability of a unique or best pension plan. A few years back, the Government launched the New Pension Scheme (NPS). However, it doesn’t take the popularity as was expected. Again, one more pension plan launched by the Government.

How much pension you can get?

The buzzing word, that may attract you about this scheme is a GUARANTEED PENSION. This scheme offers you the minimum guaranteed pension of Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs.4, 000 or Rs.5, 000 per month. This pension will start once you attain the age of 60 years, depending on the contributions made by the subscribers.

Who can invest in this scheme?

Below are the eligibility conditions for investing in this scheme-

- Your age must be within 18-40 Yrs of age.

- You must have a Savings Bank Account.

- You must be in possession of a mobile phone. This number you must provide during registration.

How much Government will contribute to this scheme?

The Government will also contribute 50% of the total contribution or Rs.1, 000 per year, whichever is lower, for 5 years i.e. from 2015-16 to 2019-20. However, to get this Government contribution, you must enroll for this scheme from 1st June 2015 to 31st December 2015.

Please remember that this Government contribution will not be available for INCOME TAX PAYERS or individuals who are already members of schemes like

- Employees’ Provident Fund & Miscellaneous Provision Act, 1952 (EPF)

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security schemes.

Who administers this scheme?

This scheme is administered by PFRDA / Governments.

How to invest in this scheme?

- Approach your bank branch where you have a savings account.

- Fill the APY Registration Form.

- Provide Aadhaar/Mobile number.

- Ensure sufficient balance in saving account for monthly transfer. Because your monthly investment in this scheme will be through an auto-debit facility.

What will be the auto-debit date?

Your initial investment date is considered as monthly auto-debit date of investment.

Whether Aadhar is mandatory?

No, it is not mandatory. However, Aadhaar is a primary KYC document.

Nomination mandatory?

Yes, it is mandatory.

How many APY accounts, one can have?

You can have only one APY account.

Whether one can increase or decrease the contribution?

Yes, you can increase or decrease the contribution as and when required.

What will happen in case you miss a monthly contribution?

In case you will not maintain the sufficient balance on auto-debit date, then the account will be treated as default. Banks may collect the penalty for this. Such penalty varies from Rs. 1 to Rs.10 per month. Government sets a limit for this penalty as below.

- Rs.1 per month penalty if your monthly contribution is up to Rs.100.

- Rs.2 per month penalty if your monthly contribution is up to Rs.101 to Rs.500.

- Rs.5 per month penalty if your monthly contribution is up to Rs.501 to Rs.1, 000.

- Rs.10 per month penalty if your monthly contribution is beyond Rs.1, 001.

In case you discontinue the contribution, then following actions will be taken.

- After 6 months, the account will be frozen.

- After 12 months, the account will be deactivated.

- After 24 months, the account will be closed.

How to withdraw from APY?

- On attaining the age of 60 yrs-You have to fill the exit form with 100% anuitisation of pension wealth. Your pension starts immediately.

- In case of death of the subscriber, the pension will continue to spouse. On the death of both subscriber and spouse, the pension corpus would be returned to the nominee.

- Exit before 60 years of age is permitted only case of the death of a subscriber or terminal disease.

Settlement in a case of death of the subscriber before attaining the age of 60 years

If subscriber died before attaining the age of 60 years of age, then the below rules will apply.

If death occurs before attaining the age of 60 years of age, then his or her spouse will be allowed to continue the account in their name. The account will attain the eligibility for a pension once the age of original subscriber age reaches 60 years of age. After that, the spouse of the deceased subscriber will be eligible to receive the pension as usual.

However, if spouse not interested to continue the account, then the account will be closed and the accumulated corpus will be given to the spouse. If spouse not alive, then it will be payable to the nominee.

Whether you get a statement of investment?

Along with regular SMS to your registered mobile number, you also receive the account statement.

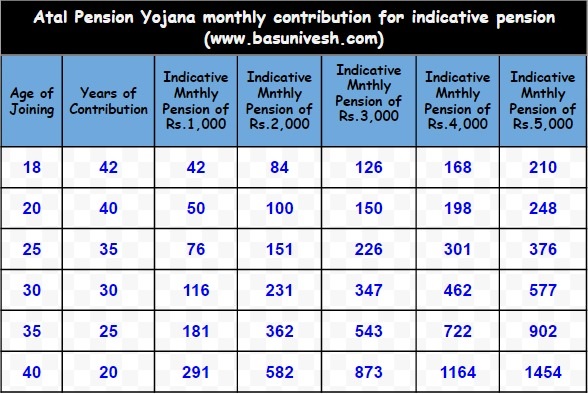

In the below chart, I explained how much an individual to contribute to receive the various minimum pension.

Whether it is worth to subscribe?

At first let us analyze whether this was necessary or not. We have already NPS (New Pension Scheme) Swalamban Scheme. Hence, what is the necessity of one more scheme? I feel it’s more of a political stunt to create the history by launching a number of schemes.

Let us glance at the first image of this post. They showed the indicative accumulation to get Rs.5, 000 per month pension. Let us say you are 20 Yrs old, and then you have to contribute Rs.248 for 40 years. You accumulate Rs.8,50,000 at the age of 60 Yrs. Even though it is indicative, but still gives a hint about the expectation from this scheme. The returns will be shown as around 8%. Whether investing so long for retirement goal and expecting a return of 8% is worth? A simple PPF monthly contribution (however, there is a yearly maximum restriction of Rs.1, 50,000) will fetch you more than this.

Along with that, you do not feel the liquidity of your investment. All your investment will be turned to an annuity. Even they are not offering you the some percentage of commutation at the age of 60 yrs.

One major drawback of this scheme is taxation. They have not provided any tax benefit. Hence, the pension you receive from this scheme will be taxable income for you.

The Government contributes an equal amount (or maximum Rs.1, 000 per year) for only five years. However, see the conditions of eligible candidates to avail this Government contribution. First, you must not be a taxpayer and second not a member of an EPF kind of schemes. Hence, a large number of individuals automatically not eligible for this benefit. Along with that, they contribute only up to 5 years. Hence, I think this is just a political gimmick than a promotion of a true pension scheme.

How to download your ePRAN or transaction statement of APY or Atal Pension Yojana?

The facility to download and/or print ePRAN Card and Transaction Statement is made available. You can access your ePRAN Card and Transaction Statement through CRA NPS Lite website (www.npslite-nsdl.com). You have an option to search your ePRAN Card and Transaction Statement with/without PRAN details. You are then required to provide minimum details like PRAN and Bank Account Number or Subscriber Name, Bank Account Number and Date of birth registered in the CRA system under APY.

How to track your APY Grievances?

An Email/SMS alert (along with Token No.) is sent to APY Subscriber on generation and resolution of a grievance in CRA system.

hi Basu ji

I have an APY account in canera bank every month detucting 300INR from my account

1. I missed my account details

2.how can I check my account status

3. what is the max age of joining of APY

KINDLY REPLY

Dear Prakash,

Please contact the PFRDA or nearest Point of Service of PFRDA.

Hi Basu,

I like your articles and analysis very much.

I have a query that can me and wife have separate APY contribution and pensions separately. So that we can contribute and have a respectable maximum pension output from this Social security scheme.

Other than this POMIS is the only plan to maximise your current and future guarateedly.

Please guide.

Regards,

VG

VG-Yes, you can do so for both of you and start investing. But do you feel this scheme will fulfill your retirement requirement?

1. I have EPS under EPF. Can I get both pension from EPS & APY, after 60 years age ?

2. A person can get 2 pension at a time ?

Sinthiya-1) YES.

2) Why not?

Can one individual have both Atal pension yojna and Enps (individual) at a time ??

Shyam-YES.

hello sir

i have a doubt in the contribution part

lets cosider my age is 22 then my contribution per month for 5000 will be 248. once i reach 25 will my contribution amount change to 376… and so on…??

Mitesh-I replied to your FB doubt.

I am Private Sector Employee. I have EPF. Am I eligible for APY ?

Sinthiya-YES.

How and when get back APY paid amount after cancellation of APY

Bhagyashree-While closing you have to submit bank details. They credit to your bank.

I want to change my apy bank account.baroda Rajasthan Kshatriya Garmin bank to icici bank.please guide me

Sanjay-You can do so by submitting the bank change request at any of the POS of PFRDA.

my sister age 21 single person i am apply AYP scheme

1.my sister working before marriage died what claim lump amount or pension amount my mother a/c ? AND

2.After marriage age 35 before DIED what claim pension amount my husband a/c ?

Feroz-I updated this section. Refer the above post once again. You will get answer.

Dear Basavaraj,

My DOB is 28 Feb 1977, am i eligible for opening APY. Pls reply me.

Thanks in advance

Murugesan-You completed 40 years and currently, your age is 41 Yrs (running). Hence, you can’t apply for this.

The current maximum guaranteed pension is Rs 5,000 per month. “All suggestions are being deliberated. One is to add slabs in the minimum guaranteed pension amount. The highest slab could be up to Rs 10,000/15000” said a government official

Vikram-Let him announce the same OFFICIALLY.

Dear Sir,

Very informative. Thanks for sharing this details. I have a question sir, What will happen if I start paying the taxes for the income or become an NRI after 2 years of opening the Atal Pension Yojna?

Regards,

Johny

Johny-They immediately stop contributing of their part once you turn to be tax payer. Once you turn NRI, then you must inform to PFRDA regarding the same.

what will the fate of apy if a contributer died in the middle of the scheme

Deenabandhu-If contributor to APY dies before attaining the age of retirement, then the accumulated amount will be returned to his nominee.

Hello,

I have opened APY thru SBI which is not my branch where I operate Account . I tried Contacting my Branch manager to share me APY Last year investment for 80C , but they could not provide me saying that my account was not created at there branch , so wont be able to provide me the statement. As I am not in Country, I am not able to reach the branch where i had opened APY. Is there anyway in NSDL or other govt. site where I can register & check my account details online by self. OR anyway where i can reach them to get my details .

Does APY provides any provision to operated online ???

Mayank-You can use this link of NSDL to complain.

It is possible to change scheme 1000 to 5000 in APY??? Please advise.

Prakash-YES.

Hi

Please give the details if changing the spouse name in atal pension yojna.

I also want to change the bank details as well.

Please assist.

Thanks

Amit-You have to contact PFRDA for the same.

Hi sir,

First I started APY Scheme in HDFC bank.There is no continuity of payment in my scheme. can I start the scheme in ICICI bank by carry forwarding the amount deducted in HDFC to ICICI using PRAN number.

or

Can I start a new scheme in ICICI bank,leaving the deducted amount.

Deepika-No, using the same APY and PRAN you can start investing through ICICI Bank.

Can I join both National Pension Scheme (NPS) and Atal Pension Yojana (APJ) at a time?

Navya-YES. Because there is no such restriction mentioned AS OF NOW.

my age 24 years i paying mothly 346 per month apy sir i suppose will be pay for 20years before the 60 years which i will get pension amount or lum some amount .

Abdul-You are not allowed to withdraw before 60 yrs of age.

I just wanted to check if the APY scheme offers a lifetime pension or is there any restrictions to it. Say like 5 year or 10 year after the retirement. Please advise.`

Anand-It is lifetime.

My daughter has joined the APY scheme,but has not got yet PRAN ,How I will get

Sujit-Contact PFRDA or Bank.

how many days do apy death claim is processed

Micky-As of now there is no such procedure set up.

SIR MY MOTHER (WIDOWER) REGISTERED AND RECEIVED ACKNOWLEDGEMENT OF ATAL PENSION YOJNA ON 30-12-2015 ( monthly contribution 5000)

DIED UNFORTUNATELY ON 10-01-2016 DUE TO SUDDEN HEART STROKE

CAN WE CLAIM FOR CORPUS SIR if so what will be corpus amount fund value or 8.5 lakh

please reply sir

Sandeep-Sir you not get Rs.8.5 lakh, but the invested amount with interest ONLY.

After 10 yrs if i want to close my apy account whether i get the given amount(for the last 10 yrs) with interest??

I am a tax payer having employee provident fund.can I apply for apy?

Can i have the tax benefit under 80/c or 80/d ?

Please state me the drawbacks of this apy scheme..

Looking forward for ur kind attention

Thanks and regards

Avishek

Avishek-Please read the exit options mentioned above. Yes, you can open this account even if you are tax payer. No, there is no tax benefit by investing in this account. In fact the pension is taxable income to you.

SIR MY MOTHER (WIDOWER) REGISTERED AND RECEIVED ACKNOWLEDGEMENT OF ATAL PENSION YOJNA ON 30-12-2015

DIED UNFORTUNATELY ON 10-01-2016 DUE TO SUDDEN HEART STROKE

WE RECEIVED MESSAGE THAT ATAL PENSION YOJNA ACTIVATED ON 16/01/2016

CAN WE CLAIM FOR CORPUS SIR PLEASE REPLY SIR

PLEASE EXPLAIN THE PROCESS SIR

Micky-check your facts. Because your mother died on 10th January but you received message stating that the account activated on 16th. I think not.

sir what are accidental deaths according to sbi and lic

sir my mother has sbi accidental cover of 10 lacs as my mother died of sudden heart stroke ( first stroke to a healthy person) can we claim or not sir please explain

thank you a lot sir providing information sir

Micky-Heart attack is not considered as accidental death. For further clarification or definition, you can contact respective insurance companies.

sir my mother buyed a policy( new endowment 814 sum assured 2lakhs ) on 24-12-2015

and died unfortunately on 10-01-2016 due to sudden heart attack can we claim for that policy sir

Micky-YES.

sir what diseases under what conditions comes under accidental death

Micky-It is hard to describe. Because it depends on insurance company.

sir how can we claim atal pension yojnaa corpus

please explain the process to claim sir please

Micky-Contact bank.

sir death due to sudden heart attack ( first stroke to a healthy person) is accidental or natural death according to irda rules and sbi rules

Micky-Natural death.

SIR MY MOTHER (WIDOWER) REGISTERED AND RECEIVED ACKNOWLEDGEMENT OF ATAL PENSION YOJNA ON 30-12-2015

DIED UNFORTUNATELY ON 10-01-2016 DUE TO SUDDEN HEART STROKE

CAN WE CLAIM FOR CORPUS SIR PLEASE REPLY SIR

Micky-Yes.

Hi Basu,

I am an avid reader of your blog, its a wonderful Financial information repository …

I have few queries

1. Can an Income Tax payer (private service) be enrolled in APY? Its understood he wont get Govt contribution, but still is he eligible to open an APY account?

2. Can two holders of a Savings bank account (Either or Survivor mode) be enrolled in APY ,each with their individual PRAN nos?

3. Is there any website to see the APY Account/ monthly contribution made? Apart from the monthly SMS alerts?

4. With the same PRAN no. generated for APY , can the APY subscriber still open an National Pension Scheme Acc?

Thereby is it legal to have APY and NPS both active (on same PRAN or on different PRANS) for a single subsciber?

Biswaroop-1) YES. 2) YES. Because their APY accounts are considered differently based on PRAN. 3) As of now no such facility. But I hope PFRDA will come up with this feature. 4) YES, there is no such restriction mentioned either in APY or NPS.

Hi Basu,

I had again posted this query in PMJDY contact forum

“1. Can an Income Tax payer (private service) be enrolled in APY? Its understood he wont get Govt contribution, but still is he eligible to open an APY account?”

But i got this reply:

Sir its is not possible for an Income Tax payer to re registered in APY from SBI/any bank.

As per SBI bank officials i got my APY account opened and was even assigned a PRAN

I have started the ECS for monthly premiums since Nov 15

Q> But this conflict is troubling me! Would this be not honored at 60yrs?

Q> I did not receive the PRAN card for APY

Also when i tried searching for this PRAN no. alloted to me in CRA-NSDL , there were no Records found!

Presently i want to open an NPS acoount but my already activated APY-PRAN has no search records!!

Kindly share your views

Biswaroop-As far as I Know, I am sure that IT payer can still open APY. There is no such restriction. Let them show the rulebook of the same.

Hi Basavaraj,

My age being 36 now and if I opt for 5000/- per month pension scheme, I will pay 990 per month (for next 24 years). Suppose I get pension of 5000/- per month for next 10 years after my age of 60 years, and supposedly I die at 70 years of age; my questions are:

1. As I understand – after my death, will my wife continue to get the same pension amount (5000/-) till her life-time?

2. After my wife’s death in next 5 years after me,

(a) will the nominee (my daughter) get the pension corpus / lumpsum of Rs. 8.50 Lakhs as given in the table against 5000/- pension amount column? or…

(b) will she just get the accumulated principle paid by me during these 24 years, which roughly comes to 2.85 Lakhs (i.e. 990 per month X 12 months X24 years = 2,85,120)? or…

(c) will she get the pension corpus after deducting our paid out pensions of 5000/- per month for 15 years (10 years paid to me and 5 years paid to my wife after me)?

Thanks in advance.

—

Best Regards,

Ravi A.

Ravi-1) Yes. 2) They provide pension corpus.

Hi Basu,

Regarding Point #2, how much would be this pension corpus? Is it fixed (8.50 Lakhs) in case of 5000/- monthly pension option. Or will it be variable / subjective based on few factors? Thanks for clarifying this.

—

Br, Ravi

Ravi-It is not clear whether it is Rs.8.5 lakh or what. But I assume it will be Rs.8.5 lakh.

Sir what if i have not paid any income tax till dec, 2015 and have enrolled for APY in Dec 2015 but I might be giving income tax later?

Will I not get the benefit?

MPK-The grace period ended on 31st December, 2015 itself. No if you open, then there will be no Govt contribution.

sir, (1) in APY after the death of both subscriver and spouse in same time ,tell me who will get corpus amount if nominee is also spouse. or

(2) if spouse is also a nominee, can nominee eligible for both pension and corpus amount after the death of subscriber.

kindly clarify above queries.

Satish-1) It will be legal heir of subscriber.

2) Nominee will be eligible for pension.

Sir, I have enrolled in APY for Rs. 5000 PM. I wanted to know that can i get old age pension (From State Government) and APY pension both after 60 Years of age or not ?

Please confirm sir.

PCM-YES.

Thank you very much for reply sir.

Iam taken apy scheme 17 months installments is paid after i have not intrested this apy but my money is refunded are not refunded pls give me clarity

Ajay-The conditions are explained above. Please take the pain to read.

I already registsred in APY and my two months contribution deducted from SBI. but I had not received any document from bank or APY? Bank or APY call center couldnot tell any information aboot what document I will get. one sms I had received only mentioning PRAN number. HAVE ANY ONLINE CHECKING SYSTEM IN APY OR CAN I GET ANY PHYSICAL DOCUMENT?.

Sanjay-If you received PRAN then ask PFRDA or NSDL.

sir nps lite band ho gyi ya chalu hai

mein nps lite k liye form fill krke send kar diya 3 month ho gye abhi tak mera pran card nhi aaya hai kya ye change ho gyi , apy mein convert ho kar aayegaplz tell me

Manoj-I already replied to your Facebook message.

my wife’s date of birth is 25/12/1983 but the dena bank has entered 25/12/1993, what can be done in this case?, bank staff is helpless, please tell me how it can be change.

Pramod-They are the one who have to rectify. Provide the correct proof and let them rectify.

I am Sunil, Currently working in Qatar as Ass. Accountant with monthly salary 55000 INR. I am married and have dependent parents and wife. We are staying in rented room having INR 11000 rent. After all monthly expenses I am having INR 20000 saving from which I want to keep INR 10000 safe in bank and balance I would like to invest as SIP. I dont have any idea of share market can treat me as beginner.

I want to invest INR 5000 for Long Term and INR 5000 for Short Term.

Long Term Plan Include Pur. of House in Navi Mumbai by 2022.

Short Term Plan Include Insurance for Self and Wife (recently married) and Maternity & Medical exp. (3 year later)

Pls. provide your valuable suggestions or Suggest if i can go through fundindia or friendly agent.

Thanks

Sunil-You are completely wrong. Why you want to keep aside Rs.10,000 safely? Once, you created emergency fund then idle cash is not required. Instead, invest it based on your goals. Also, Term Insurance is not a short term plan? It is an emergency plan, which you must do immediately. I am not sure your dream will come true with monthly investment of Rs.5,000 to have a house in Navi Mumbai. First create an emergency fund of at least around 6-12 months household expenses, buy term insurance, medical insurance and accidental insurance. Later on think about investment.

NPS or APY? for deduction (additional 50K in addition to 1.5 Lakh of 80c) under the 80 CCD to save my tax.

If NPS which schene would be better?

Pankaj-No such tax facilities are available for APY. NPS have that facility. To me both are crap.

Sir

I am unmarried. So later when I get married, will I be able to add the name of my spouse ? And change the name of my nominee ?

Kindly let me know.

Thanks

Paromita-Yes, you can change the nominee.

Sir, Please adv for House-wife of Age-33,which scheme will be better NPS or APY or any other Pension Product…

I am afford to invest Rs 1000-/- per Month..

Prem-Invest in a single large cap mutual fund. That is enough.

sir

I am a state govt Teacher. I have no any govt. pension scheem till date..

can i aply in APY scheem and i credit 10& 15 stallment and then died.

after death what refund and how many time after received my wife.

please discrib detail…

Umesh-You can subscribe. It is not clear about what they will return in case subscriber dies before 60 years of age. Let us wait for clarity.

Thank you for posting the details and making it crystal clear for the people.

After 60years death of spouse how much amount payment to the nominee (monthly pension 5000).

can bank employees and state govt teachers are eligible to join APY.

Chinna-Yes, because as of now there is no such restriction mentioned.

The Govt. employees who comes under New Pension System and having PRAN No. are not eligible for APY but, who join before 2004 and comes under Old Pension System are eligible to apply for APY, am I right Sir??

Tinku-There is no clarity on this (as of now).

Dear Sir,

I’m just complete my master degree. If in future I get any gov. job where tax applicable. If l now join this programme can get benefits of this plan.Does it cancel after getting gov job ?

Dipak-You can join this scheme. There is no cancellation.

Thanks sir

but sir this scheme is not for those who are income tax payer ?

Shyam-Who said? Refer above details properly.

My brother dob is 03-03-1977. He is not married. He was uneducated and Paralysis person. I want to join this scheme. I want to held him by creating this atal pension scheme for future. Please give directions for further needful. What is the amount to be pay for this scheme.

Anitha-You can open the account in his name. Procedure is already mentioned above. How much to pay is actually depends on you.

Sir my dob is 30.12.87 .for 5000 pension what will be my monthly amont if account open before june 30,2015.

Richa-Your age is 28 Yrs. So you have to pay monthly Rs.485.

Dear sir for ex one person giving his 1st apy instalment then he died .there for what results ?

Abdul-Exit option before 60 years of age is only in case of DEATH. But how much you get is not yet clear. But in my view (not sure), one may get invested corpus along with interest up to date of death.

Sir I have applied for APY last month ..but now I feel its not worth ..can I stop it .

Sharmila-Yes, you can stop.

Hi Sir,

Please can you confirm whether the monthly deposited amount can be shown for tax saving purposes (TDS exemption )?

Alok

Alok-There is no tax benefit (as per current law) of investing in this scheme.

One major drawback of this scheme is taxation. They have not provided any tax benefit. Hence, the pension you receive from this scheme will be taxable income for you.

Hi Sir,

I have few question on APY,

1. I am planning we both ( Me and my Wife ) to join this APY. Suppose I died at age of 61 age, Will she get Pension ? As all read she is having the same plan.

2. If yes, it means ( My pension + Her pension ) both include 5000 + 5000 will she get ?

3. As what we are give called as ( Principal Amount ) till 60th Age. Will we get ? If yes , who will get ?

4. Suppose I did not joined to this plan, Only my wife joined to this plan. After her death will I get Pension ?

5. What is the different between NPS & APY.

Please reply one by one of all my question. Please don’t include all your answer in single statements.

Thanks & Regards

Tapan

Tapan-1) Yes. 2) Yes. 3) Yes the pension will be payable to your spouse. Once she dies then the nominee will receive such pension corpus. 4) Yes, if she died before you then you get the pension. 5) Lot of difference which I can’t explain here.

Can aHouse wife open a APY ACCOUNT

2)If someone is not a tax payer now . Can He/She continues to be eligible if he /she pays tax after some time

Srinivas-Yes, she can open it. Yes, taxation is not an issue to be a member of this scheme.

DOB: 27/4/1975, am I eligible for this scheme because there was a little confusion so now will I get all the benefits of atal pension scheme if i join

Parinitha-There is no clarity on this. Let us wait.

Good Job, It’s useful information.

Thanks.

After commencemant of pension at age 60 if i died at age 62. Is anything payable to nominee. what about return of my accumulated ammount? will it be returned?

Sumu-If your death occurs after pension start then as I mentioned above the said rule will apply “In case of death of the subscriber, the pension will continue to spouse. On the death of both subscriber and spouse, the pension corpus would be returned to the nominee.”.

my instalment of 1454 has been deducted from my saving account so then am I now will get all the benefits of atal pension scheme as there was a little bit of confusion with my birth date 5- 5 – 1975 so some were saying no and some were saying no

Nitesh-Wait and watch 🙂

YOU ARE DOING EXCELLENT SERVICE TO COMMON MAN .YOUR EFFORTS ARE APPRECIATED.

Vasant-Pleasure 🙂

Sir kindly suggest me on Apy…am govt employee and have taken New pension scheme….can I invest in Apy?

Birbal-Yes, you can be a member of this scheme. But I don’t think it is necessary if you already a member of NPS (by default).

Sir, please tell me what happened after successful completed of filling monthly contribution at the age of 60. After that a lump-sum amount will be paid to pensioner and then started the Pension or they didn’t give any lump-sum amount and only they paid monthly pension.

Hitesh-This is what I already said above. There is no such % of commutation (lump sum payment once you reach 60 Yrs of age). But all the accumulated amount will turn to monthly pension.

Hi SIr,

I have one question, how did you arrive that the return from this scheme would be 8%?

Also , one merit of this scheme that I saw is the subscriber will get 5000 INR till death..However other instruments will give the entire corpus at once and will not feed the person until his death.

What are your views on this?

Mohit-I arrived at around 8% return considering the amount they siad to invest and probable pension they mentioned. Is it merit to get Rs.5,000 constant stream of pension throughout life? What about inflation?

Hello sir, please clerify me if you know. my age is 38 yrs and my contribution amount is Rs.902 for Rs.5000 pension scheme for 25 yrs term. Befor 60yrs of my age if i unfortunantly died then how much money will get my spouse ?

Ajay-It depends on the accumulated amount. No one can say on this front.

my instalment of 1454 has been deducted from my saving account so then am I eligible for this scheme because there was a little confusion about my birth date 5- 5 -1975 so now will I get all the benefits of atal pension scheme

My birth is 06-06-1975, m I eligible for Atal Pension Yojna as I have not filled it yet and if earliest I fill it by tomorrow???

Naresh-Yes, you complete 40 Yrs tomorrow. Hence, you can open it.

Nitesh-In my view yes. Because after the KYC process only, banks deduct the premium.

Dear SIr,

I would like to join in this scheme. I am working in private concern. I think Income tax payers are not eligible for this. At present I am not paying any income Tax. But if it happens in future, will this affect in any way? And I would like to know the below details:

I am going to join Rs.5000/- plan. As per this plan I will get Rs.5000/- after my 60 years of age and after my death my husband will get the same. But if is there any death happens before end of this plan , how can we claim? and when will this amount will goes to my Nominee and on what basis of calculation? Is there any Fixed rate of interest?

Yasodha-There is no such restriction that tax payers not allowed into this scheme. You can easily enroll for this scheme. Regarding death before retirement period, they pay the accumulated amount along with interest earned on such amount to your nominee and account closes there itself.

Dear , I am a NPS subscriber , I want to contribute a amount online into my account without any charge . what I can do ? .

Gajanan-You can contribute online by using platforms like FundsIndia or ICICI Direct.

Hi Basu,

Very good analysis as usual. Good Job 🙂

IF I HAVE ALREADY OPEN NPS ACCOUNT , SHOULD I CAN OPEN I ATAL PENSION

Madhu-Yes, you can still open Atal Pension.

Dear Mr. Basu

Thanks for Information, Kindly request your for advice for following Query.

1, Govt. will Contribute in Not Tax Payer Case only , but in Future Investor will Pay Tax in F.Y. 18-19 , Will eligible

for Govt.Contribution. ?

2, What your Advice for Investment in Above Scheme , Compare to PPF or Other Pension Scheme.?

3, What is Accumulated Interest / Return on Yearly basis, in case of 33 Current Age, for Rs.1ooo Pension return ?

Rohit-Check other conditions also before arriving at the decision of Govt contribution. If you are job holder and a member of EPF then too they not contribute. I think they offer you around 8% to 9% return.

Hi Basu,

Thanks for sharing your analysis.

I just wanted 2 clarify that this APY scheme is only for salaried employees or even Professionals can go in for this scheme and get the tax benefit???

Also NPS additional benefit of Rs. 50 k – is only for salaried employees or even Professionals can go in for this scheme separately and get the tax benefit???

Thanks $ Regards,

Neela

Neela-All are eligible for this scheme. The new benefit of NPS applies to all. However, do keep in mind that all retirement corpus generated at end will be taxable income for you. I don’t think it is worth to lock in your money in such products.

Thanks a lot for your clarification Sir.

I am psu employee with salary nearly 75000/month

1. Can i get enrolled for APY

2. Can i contribute/month in such a way that i would get 10000/ month pension from APY

Rohit-Yes, you can be the member of this. But do you feel the current Rs.10,000 will value equally at your retirement?

Actullay i am having mf sip investments too.since they are ensuring fixed return in ayp it good debt scheme.moreover in future after rbi cuts rate the rate of intrest is going to fall much.so it better to invest bit in fixed pension scheme too

Rohit-Fixed return at what cost? Do you feel the interest rate changes will affect this scheme? The two major hindrances of this scheme is lock-in and taxation. Think and decide.

Monthly income in apy is taxable. Every income that you get on monthly basis other than dividend is not taxable.so its just one would get rs 5000/month at an investment of rs1196/month thats locked in at 8%. I am sure in future interest rates are going to come below 8%.this is going to b additional income.

Rohit-It is not taxable?? Check your facts.

Oh sorry its taxable

Rohit-Sir, whatever the product, as per current tax laws, the pension income is taxable. Why you are confusing this with dividend distribution? Dividend distribution is not taxable in the hand of a receiver. However, it will be taxed at distributing place itself.

It was a typographic mistake.i mean if one has sufficient investmentsin other forms then whats wrongif one can get 5000 /month as pension at expense of rs 1196/month.i am only talking of my case.

Rohit-I agree to your point. However, why my money earn less when I have best opportunities to earn more than this?

but some are saying you are eligible till 4th Nov 2015 till that day you will be considered as 40 and you can join this scheme before 4th Nov because my birth date is 5 – 5 – 1975 so can I go and fill the form please give your valuable suggestions

Nitesh-I am not sure about this. Because nowhere they written the cut-off date for age consideration. In that case how one can arrive at this assumption?

My birth date is 01.06.1975,Today at announcement I am eligible but on 01 Jun am I eligible Pls guide me?

Mahesh-I doubt, because you completed 40 years and 41 started.

My birthdate is 01.06.1975,Today I am eligible as per announcement but scheme opens on 01 June ,So Am I eligible for the scheme or not , pls guide me?

Hi I am Sivaraman when is the last date for joining

Sivaraman-There is no such last date for this.

Dear Basavaraj,

My question is

1. Is this Rs.5000, sufficient money in future after 20 yrs? Why there should be a cap?

2. For a present value Rs.1885 with a inflation rate of only 5% in 2o yrs will be the same as Rs.5000, would it be sufficient for any meaningful spending.

Or is this another just another election promise fulfilling scheme?

Who is truly benefiting??

Partho-It is a minimum pension of what they said. If one invest more then they receive more pension. It depends on an investor to judge how much retirement corpus or monthly pension he needs. Sadly, this plan not educate on that front. Yes, it is more of a political gimmick.

This scheme is for financially weaker section of the society. So comparing with PPF, tax benefits, etc. is mere stupidity. Thunk about it from the perspective of poor and the scheme is fantastic. In my opinion if a member becomes defaulter, his Co tribute ons must be refunded without any deduction or penalty, the age of maturity for receiving pension should have been 50, as the life expectancy in that scion of the society is low compared to the rich who can afford good medical facility.

Narendra-Taxation is very much important. Because current poor individual may turn out to be tax payer during time of retirement. I agree that it is basically meant for lower cadre. Life expectancy is increasing at alaram right (irrespective of rich or poor). Hence, I don’t think retirement age specified in this scheme is wrong.

my birth date is 5 – 5 – 1975 so am I eligible for this scheme because some bank staff are saying yes & some are saying no so please guide me

Nitesh-I think you are not eligible. Because you completed 40 Yrs and 41 started.

can I open two atal pension scheme one for my wife and other one for me and weather for this our joint saving account will work or I have to open new saving account of my wife’s name

Nitesh-You can open accounts as you said. But, regarding the savings account, I suggest to discuss the same with your bank officials. Because as of now there is no clarity about this.

Thanks it helped

Thanks for clear and simple way to understanding skim.

Dear Basavaraj,

Very true. Thanks for sharing such useful information. People will think twice before investing.

Thanks for posting