In my earlier post, I shared my Top 10 Best SIP Mutual Funds to invest in India in 2022. In this post, let me share my Top 10 Best Debt Mutual Funds to invest in India in 2022.

When it comes to investing in debt mutual funds, you have to keep one thing in mind about the purpose of investing in Debt Funds.

Ideally, as I have explained in my earlier post, we choose debt funds mainly to diversify our investments. Hence, when we are choosing the debt funds, the primary purpose is to reduce the risk which is already there in our equity portfolio rather than chasing the yield or returns from debt funds also.

When I choose a debt portfolio, my preference always is towards the suitability of traditional debt products like Bank FDs, RDs, PPF, EPF, or SSY. If I still have room to invest in debt, then I choose debt funds.

When I say suitability of traditional debt products, it means we have to look for taxation, liquidity, and maturity of the products based on our financial goals. Hence, understanding your financial goals is the first step of investment.

I am not going to repeat again the importance of goal-based planning. I have already explained this in my earlier post “Top 10 Best SIP Mutual Funds to invest in India in 2022“.

Hence, in this post, I will directly jump toward sharing my debt funds.

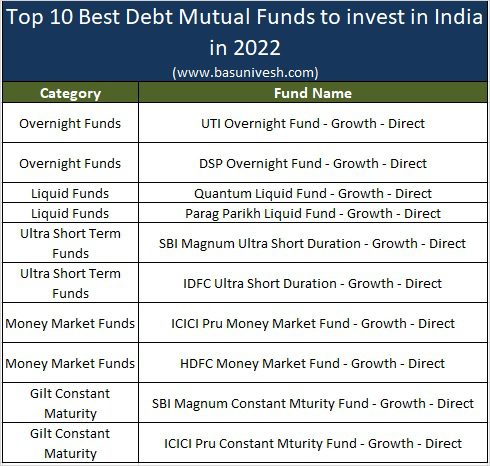

Top 10 Best Debt Mutual Funds to invest in India in 2022

As I pointed out above, the primary purpose of choosing debt is to diversify your investment and thereby reduce the risk and volatility which is already there in your equity portfolio. Another purpose of choosing debt is when your goal is short-term in nature or when you have to move equity to debt as you are nearer to the goal.

If you are choosing the debt products to generate higher returns, then you are on the wrong path. I am not saying that we must ignore the returns. However, safety with decent and tax-efficient product choice is the primary purpose. Otherwise, we may end up with situations like “Franklin Templeton India Closed 6 Debt Funds – Is it right?” or “Is Liquid Fund Safe and alternative to Savings Account?“.

Before reading further, I request you to refer to my earlier posts I wrote on debt funds.

- Whether Gilt Mutual Funds are Safe?

- Debt Mutual Funds – Truths Mutual Fund Companies did not tell you

- Mutual Funds Inter-Scheme Transfer – Hybrid Funds are risky now?

- Credit Downgrade or Default Risk in Debt Mutual Funds – What are the alternatives?

- Whether Banking and PSU Debt Funds are SAFE?

Now let us move on to debt funds recommendations. You may notice that there are various categories of debt funds available in the market. Mutual Fund companies force us to believe that all these categories are NEED for us but not WANT. However, we don’t need all those categories at all to create our debt portfolio.

As I mentioned above, the first priority should be given to traditional products. Use Bank FDs or RDs if your requirement is within three years. No harm in that. Don’t believe in the trap of the so-called finance industry as there is no great advantage of parking your money in their recommended debt funds. Because if your purpose is within three years, then the taxation of FDs and RDs is the same as that of debt funds. Above that, there is no such huge return difference by choosing the debt funds. Hence, simply choose Bank FDs or RDs for such requirements.

However, one drawback of FDs and RDs is that you have to define the time horizon well in advance. Hence, if you are unsure of when you need the money exactly, then you can use the debt funds.

Now let us move to the Top 10 Best Debt Mutual Funds to invest in India in 2022.

# Overnight Funds

You can choose any fund of your choice as the risk is minimal here. Just check whether the fund has a decent AUM and low expense ratio. Accordingly, you can choose as per your comfort. Use overnight funds to park your surplus which you are of unsure to utilize and in need of within few days or months.

In my case, what I have noticed is that many people simply park the money in a savings account as they don’t know what to do with that money. In such a situation, rather than parking in a savings account, you can use overnight funds. Because if something went wrong with your internet banking or debit card, your money will vanish within few seconds. Hence, use overnight funds or short-term FDs for such purposes.

My choices of overnight funds are as below.

- UTI Overnight Fund

- DSP Overnight Fund

# Liquid Funds

You can use Liquid Funds when you have to park your money for more than few days or accumulate for your short-term goals like yearly travel, kids educational fee, or any such recurring goals (if you are uncomfortable with RD).

You can use Liquid Funds as an alternative to FDs or RDs when you are unsure of exactly when you need the money. However, I am against the concept of using Liquid Funds to park emergency fund. The main reason for parking the emergency fund is LIQUIDITY and SAFETY. I am not questioning the safety of Liquid Funds. However, liquidity is a question mark (few funds offer instant redemption of Rs.50,000 a day. But what if your requirement is more than this?). Because it usually takes around 1-2 days to credit in your bank account. Hence, to park your emergency fund, I strongly suggest you utilize Bank FDs and park few months of expenses in a savings account.

My choice of liquid funds are as below.

- Quantum Liquid Fund (NOT QUANT LIQUID FUND)

- Parag Parikh Liquid Fund

# Ultra Short Term Debt Funds

Ideally, Ultra Short Term Debt Funds invests in Debt and Money Market instruments such that the Macaulay duration of the portfolio is between 3 months -6 months. You can use either Ultra Short Term Debt Funds or Money Market Funds for your short to medium-term goals. My recommendations in this category are as below.

- SBI Magnum Ultra Short Duration

- IDFC Ultra Short Term Debt Fund

# Money Market Funds

Money Market Funds are the funds where a fund manager will invest in money market instruments maturing for up to 1 year. Suitable for your long-term portfolio creation if your goal is more than 3 years or so.

My choice of funds are as below.

- ICICI Pru Money Market Fund

- HDFC Money Market Fund

# Gilt Constant Maturity Funds

Gilt Constant Maturity Funds means they invest in Government Of India bonds which will mature in another 10 years. As major holdings of the fund are in long-term bonds majorly, this category is highly sensitive to the interest movement. Hence, use this fund category only if your goal is long-term and if you are ready to digest some volatility. Of course, there will not be any default or downgrade risk.

My recommendations in this category are –

- SBI Magnum Constant Maturity Fund

- ICICI Pru Constant Maturity Gilt Fund

If you are not accustomed to volatility, then use the Gilt Long Term Funds. Here, there is no classic definition of what should be the maturity of underlying bonds. Hence, the style changes from fund to fund. However, they may be a little less risky than the Constant Maturity Fund. But it does not mean that you have to use such funds for short-term goals. Make sure to include Gilt only if your goal is more than 10 years. In Gilt Long Term Funds, you can use SBI Gilt Fund or ICICI Gilt Fund.

You have to come out from Gilt once your goal is nearer. Take for example, assume that your goal is around 15 years away. You have to come out from Gilt once the goal is around 10 years away. Don’t keep this in your portfolio if your goal is less than 10 years or so.

Finally, the list is as below.

How do I construct a Debt portfolio?

For few days of parking, you can use Overnight Funds.

For goals that are less than three years, I prefer FDs or RDs. However, if you are unsure of when you need it exactly, then you can use Liquid Funds.

If your goals are more than 3 years but less than 10 years, I prefer Money Market Funds or Ultra Short Term Debt Funds.

If your goals are more than 10 years away, then first fill the gap with PPF, EPF or SSY. If you still have a room, then suggest you to park the remaining amount 50% in either Ultra Short Term or Money Market and the remaining 50% in Gilt (Either Long Term or Constant Maturity).

Dump the rest of the categories of funds as the main idea of debt is safety and diversification rather than chasing the returns.

Caution – Do remember that debt funds portfolio use to change frequently and hence keeping an eye on your portfolio is very much important. That is the reason I used to say that if you don’t know in which debt funds you are investing, then debt funds may be riskier than equity funds.

Hence, these fund recommendations are generic in nature. Do your own research before choosing the funds or hire a “Fee-Only Financial Planner“.

12 Responses

HI Sir

When I look into other articles and websites on top Liquid fund -> they are suggesting Quant. And I see that you have specifically mentioned not that and suggest Quantum. An I do understand that they are mainly looking at 1 year returns which may not be the nest way to find the best. IS there any specific parameter (like risk) has has made you choose this over that. Please help me learn more on this.

Dear JJ,

It is mainly because of SAFETY by looking at the underlying assets.

Hi BasuNivesh,

Thank you for the well written informative article.. can you please throw some light on UTI TREASURY advantage fund (growth) direct plan & Baroda Bsnl Paribas credit risk fund direct growth?

Dear B,

You can hold UTI. However, avoid categories like credit risk funds.

Basu, How to use PPF in the unified portfolio where the last goal due in 18 years and first goal due in 9 years. After completing 15 years of PPF, should i close PPF and move the corpus to Money Market fund.

Liquidity is big concern in PPF, i am unable to do rebalance from PPF to Equity whenever my Target AA of Equity goes below.

Can i consider Gilt fund (Const Maturity) instead of PPF for long term goals.

Dear Devan,

Use PPF only for the goals which are 15+ years (especially if the PPF is recently started). Otherwise, the maturity date and add 5+ years. Else it will be difficult for you to manage with PPF. Regarding rebalancing and liquidity, I always insist to have a certain portion of debt in debt funds where liquidity is highest. Hence, yes, you can consider Gilt. But make sure that you understand the volatility of Gilt Funds.

Regarding Gilt fund, bit confused which one to choose Pure Gilt vs Const Maturity Gilt fund. Though the later one is like index fund but higher volatility and no FM risk in it.

Devan,

Currently constant maturity funds are risky as inflation is inching up and such funds can’t reduce their average maturity by holding short-term gilts. Hence, if you are unable to digest volatility, then avoid the constant maturity fund and simply adopt Gilt. Because Gilt Funds drastically reduced the average maturity after the trend in interest rate cycle reversal started.

I have ppf as my debt portion. It’s matured and extended for another 5 years. Now I need to Rebalance my portfolio to desired AA. Shall I partial withdraw from ppf and invest equity.

Dear Kalai,

Yes, you can.

Hi,

This is very good article. Most of the investors use only Equity Funds. But if one has to use Debt Funds for some reason, such as, asset balancing or SWP, then this article will help.

Most of the midterm and long term debt funds are giving negative returns in past six month, as Central bank of India has started increasing rates. This is very common whenever interest rates start rising. One generally use Debt Funds to protect capital, and such negative returns often come with volatility.

It is best to avoid mid term and long term debt funds fully, as you never know, when the tide changes and interest rate rise starts. Timing investments is not easy in mid term and long term debt funds.

I have been investing in debt funds since past decade and can corelate with this article. Post 2014, since interest rates have been mostly going down, so debt returns look good but it could be very difficult to generate positive or meaningful returns in debt funds over next few years. Hence sticking to Liquid, Money Market funds seem to be the safe option.

Thanks for this article at right time.

Dear Gunesh,

Thanks for sharing your experience. I completely endorse your views.