Are you National Pension Scheme (NPS) investors? Are you investing just for the purpose of additional tax benefits? Or are you investing thinking that it is Government managed product and hence there is the highest degree of safety? Let me clear all your these myths in this post.

As I pointed above, many of us invest in National Pension Scheme (NPS) with the sole intention that it gives additional Rs.50,000 tax benefit which is beyond the Sec.80C limit. For few Central and State Government Employees (even for few private sector employees) it is mandatory to invest.

Few invest in this scheme thinking that it is a Government launched product. Hence, there is no RISK in this. All these investors are unaware of the 5 biggest disadvantages of National Pension Scheme (NPS). Let me clear one by one.

# National Pension Scheme (NPS) will not provide you the pension or annuity

One of the biggest myth many of us holding since long is that National Pension Scheme (NPS) will provide us the pension when we retire. Sadly the answer is NO. National Pension Scheme (NPS) will help you to accumulate the retirement corpus. Using this retirement corpus you have to buy an annuity product or pension product from Life Insurance companies like LIC’s Jeevan Aksya VI.

However, many of us have the biggest belief that NPS itself will provide pension or annuity.

# Do you know the National Pension Scheme (NPS) tax treatment once you attain retirement age?

PFRDA, media and many middlemen pitch for tax benefits available while investing in National Pension Scheme (NPS). Sadly we just believe in these benefits and start investing. However, the National Pension Scheme (NPS) taxation when you attain retirement age is horrible to hear.

Assume that you attained Rs.1 Crore retirement corpus from National Pension Scheme (NPS). In this corpus, you have to buy an annuity or pension plan for Rs.40 lakh. This 40% mandatory buying of an annuity is mandatory.

The annuity or pension which you will receive regularly during your retirement from this Rs.40 lakh investment is taxable to you like salary income. Hence, as per your tax slab, you have to pay the tax on it.

Rest of the Rs.60 lakh you can withdraw. However, in that only Rs.40 lakh is Tax-Free. Rest for the Rs.20 lakh, you have to either pay the tax as per your tax slab or buy an annuity to defer the tax.

NONE WILL BOTHER ABOUT THIS HORRIBLE CURRENT TAX TREATMENT OF NPS.

# Risks in Scheme G (Govt Securities) Fund and Scheme C (Corporate) Fund

Do you feel SAFE if your money is invested in Scheme G (Govt Securities) Fund or Scheme C (Corporate) Fund?? It is not so safe like what you thought?

Before I point out the risk, you must understand three important principles of the bond market and they are as below.

Credit Risk-

Your National Pension Scheme (NPS) invest in Government securities and in Corporate Bonds. The credit quality of these underlying instruments are measured in terms of ratings.

Usually higher the ratings lead to lower the return or risk. It is a misconception among many that credit risk refers to risk of default by the bond issuing entity. However, the truth is something different.

There is a possibility that the credit rating of a bond or instrument the fund is holding may change at any point of time. Let us say ABC Debt Fund holding the bond of XYZ which is rated as AAA by credit rating agencies (highest rating).

It does not mean that this rating is permanent. It may change at any point of time if the company XYZ’s finance changes.

Hence, never be in a misconception that credit rating refers to default risk and also credit rating of the bond will NEVER CHANGE.

I know that there will not be any default risk in Government Securities. However, there is always a credit risk in various level when it comes to the corporate bond investment of NPS.

Modified Duration-

It is a measurement of a bond’s sensitivity to movements in interest rates. It is usually measured in years. For example, if debt mutual fund with the modified duration of 3.1% means if there is a 1% interest rate movement then the fund will undergo the movement of 3.1%.

Hence, higher the modified duration means higher the interest rate risk.

Average Maturity-

A debt fund portfolio usually consists of a number of bonds where each could have a different maturity date. Maturity is the time period remaining before which a bond comes up for repayment by the issuer. Average maturity is simply the weighted average time left up to the maturity of the various bonds in a portfolio.

Higher the average maturity greater the interest rate risk of a debt fund.

Average Maturity of National Pension Scheme (NPS) Government Securities and Corporate Bond Funds

Now in case of National Pension Scheme (NPS), let us consider only about the average maturity of Government Securities and Corporate Bonds it is holding.

You noticed that in case of Government Bonds and Corporate Securities, all fund managers holding long-term maturity bonds.

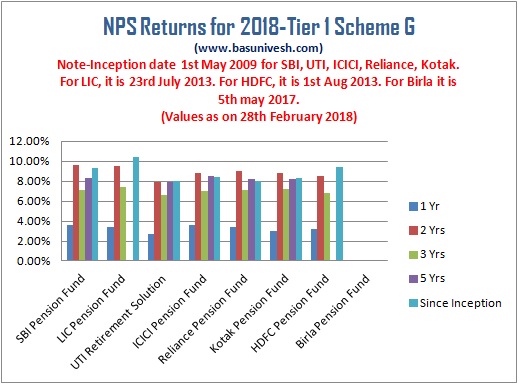

Now due to 2-3 quarters RBI’s policy that to hold the interest rate due to higher inflation, crude price rise and other factors, there is a lesser return from these two categories since two years. You may notice that by referring below images.

Notice that one-year returns for all fund managers in case of Government securities is below 4%.

However, due to a different set of credit rating and average maturity, Corporate Bond Scheme performed well than Government Securities Scheme.

What it proves? It proves that due to their long-term bond holding your money is riskier to interest rate volatility. Do you think what will be the situation of a person who is about to retire?

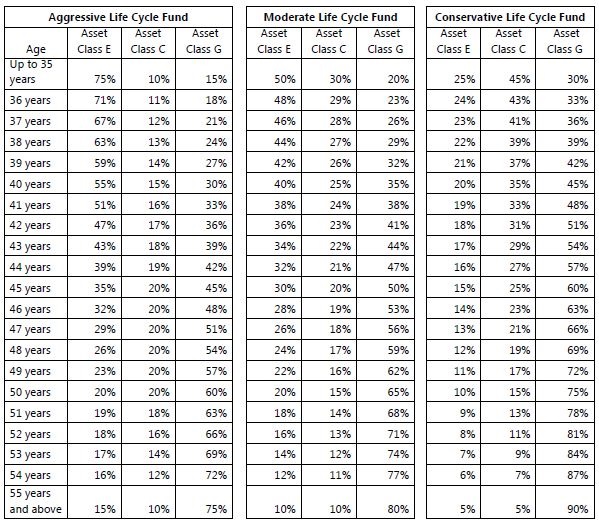

Let us consider Auto choice option of NPS. Here, assume that you are 55 years of age and opted for Aggressive Life Cycle Fund, then 75% of your asset will be in Government Securities, 10% in Corporate Securities and rest 15% in Equity. Therefore for 55 years of an aged person, his retirement corpus is still at high risk as the fund manager holding higher maturity Government Securities. If there is a fall in inflation and RBI started to reduce the interest rate, then he has to end up with 2% to 3% return on his long-term accumulated retirement corpus.

Below image will give you a clear picture of how your asset is classified under the auto choice option of NPS as per the age. However, the risk will not be reduced. But as per NPS, they are reducing your risk by moving your money to debt. But in debt, you will see how much volatility is there due to these fund managers long-term bond holdings.

However, even if you have not opted for the auto choice option, you have no other options to switch between their default equity, corporate and Govt securities portfolio.

Hence, debt portfolio of NPS is also riskier like equity.

# Expense ratio of National Pension Scheme (NPS) is lowest but unclear!!

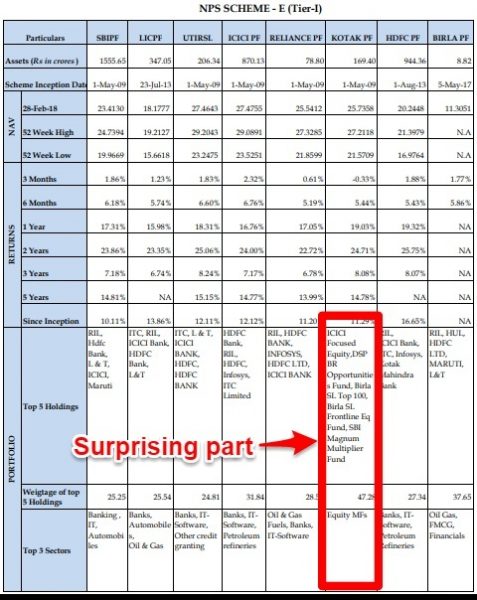

Yes, I noticed the same when I was writing a post “NPS Returns for 2018 – Who is best NPS Fund Manager?“. The reason for my doubt is from below image of PFRDA.

Just concentrate on the marked part of Kotak Fund Manager’s Equity holding for Tier 1 Scheme of NPS.

You noticed that Fund Manager investing in Equity Mutual Funds and this holding constitute around 47% of the overall equity portfolio.

The funds which Kotak Fund Manager investing are Large Cap Fund-ICICI Focussed Equity (2.23%), Multi-Cap Fund-DSPBR Opportunities Fund (2.18%), Large Cap Fund-Birla Sunlife Top 100 Fund (2.32%), Large Cap Fund-Birla Sunlife Frontline Equity Fund (2.21%) and Multi-Cap Fund-SBI Magnum Multiplier Fund (2.09%). The values mentioned in the bracket are respective funds expense ratios (as per valueresearchonline).

Kotak Fund Manager investing in 3 large-cap funds and 2 multi-cap funds. This constitutes the 47% of the portfolio. You also notice that the expense ratio of these funds are well above 2%.

In such a situation, how Kotak Fund Manager managing the NPS subscribers money at the low cost of 0.1%? Why NPS subscribers have to pay the double cost (one to Kotak Fund Manager and another cost to mutual funds)?

I think none have noticed it or there are no clear disclose to investors in this regard. This as per me, is the biggest risk to investors.

# It is a marriage between you and NPS irrespective of partial withdrawal rules

Yes, it is a marriage between you and NPS for the long-term commitment of up to your age of up to 60 years of age. Yes, I agree that there is certain liquidity is possible but only under strict conditions. Refer my earlier post in this regard “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

Hence, I feel this as the biggest hindrance. Because irrespective of the performance or your need, you have to stick to 8 fund managers and their style or stick your money up to your retirement age of 60 years.

Hope this much information will be enough for all readers to open their eyes before jumping into investing in National Pension Scheme or NPS.

Try to invest Tax Benefit of 30% (slab assumed) in SIP till your retirement age. You will get approximately equal amount that you need to keep to purchase annuity (40% of maturity value) 🙂

That means double benefit. We get pension and also will not feel bad that 40% amount is locked in annuity.

Dear Rushikesh,

Liquidity is the biggest pointer that many investors ignore.

NPS has 12% return in 10 year time frame. HDFC ,ICICI,LIC any of them managing ., does this post still hold good., or am getting it wrong ??

also without annuity at age of 70 can you withdraw entire NPS corpus …

Dear Govind,

Past performance is not an indicator of future performance. Whether it is 60 years or 70 years, you have to buy annuity.

NPS is just like a Government run chit fund. A ponzy scheme. We as government employees, are forced to invest under NPS. We don’t have any option. We know what will be snatched from our salary but we don’t know what will be the return? Even not assured that to get a single penny return fr share market linked investment scheme. NPS will not give any pension. We must to buy annuity from private company to get pension. That to with very low annuity interest rate. No dearness relief like Old Pension (OPS) to beat the inflation. No minimum pension is assured(undet ops mininmum pension is Rs.9000/- per month) pension amount may be below Rs.1000/- month. That should not be termed as pension rather that will be a begger’s alms at our old age.

NPS has no guarantee, no security, no pension scheme. Our old age are under deep threat. We demand to scrap NPS & to restore OPS immediately. Otherwise we will have to think to chsnge our government in the next election.

Dear Biswapriyo,

Thanks for airing your views.

After reading your blog, now I’m worried about my investment. I invested in nps around 20k since last one year. What should I do now sir? Stop or continue with minimal investment? I’m not invested just for tax saving.

Dear Rajkumar,

Invest minimal required to be active.

Dear Basu,

What about people from defence forces as our retirement age is till 55. Also, if one invests in PPF, and mutual funds then where is the harm in investing in NPS, ( agreed that 40% of my corpus will be used to purchase annuity) but remaining 60 percent will be tax free. its the concept of looking at a half filled glass, as it looks half empty to some people. i personally believe that its a great tool for retirement if you are already investing in equities( stocks and MF).Moreover , the pension which i get at maturity will be taxable at the rate prevalent at that time ( not to forget the enhanced limits for senior citizens which is possible that you fall in the no tax slab after receiving the pension)

Dear Shashi,

You are just looking at taxation and liquidity. But look at the portfolio.

Hi Sir,

Can you shed light on Tier 2 NPS tax rules. It’s very unclear how it will be taxed on withdrawal. Is investing in Tier 2 as good as investing in mutual funds ?

Dear Bhuvanesh,

As of now, there is no clarity. However, my assumption is they treated as equity. I stay away from NPS and hence no question of comparing NPS with Mutual Funds.

Sir, it is a Very Informative article. What should a central government employee do to optimize returns from NPS Tier-1 account as he has to make contributions in NPS…plz guide

My age – 37 years

Dear Sandeep,

Sadly you have no other options but to stick to.

It is not that bad/Sad after all as far as I see it.

Prior to the NPS system, central govt employees were already buying annuity with some % of their retirement fund indirectly. When an employee was retiring, he was getting some lumpsum amount and Govt was paying them pension directly (Now is this not equivalent to the annuity scheme in the NPS?). And since we did not know the details, there was no question asked about the %returns :). And since all these was not market linked, pension was secure and fixed no one had any problem or questions.

Now, with the introduction of NPS scheme (after the 6th Pay commission I think), Govt simply out sourced the job to third party (ICICI, SBI, HDFC etc.) and allowed them to put the money in equity market. When you compare this to the OLD regime, the lumpsum benefit which the employees used to get is equivalent to the 60% NPS corpus and employees got an option to reduce this lumpsum if they do not need it. And the regular pension in the OLD regime is the annuity thing (40% minimum) and here also people got an idea of how much pension they are going to get.

When we compare the two systems (OLD pension system and NPS):

1. The OLD system was more rigid while the new one is flexible. It has scope for both active and passive investors (We have to consider that majority of the govt employees have ~zero knowledge about investment).

2. Burdon on Govt is reduced without compromising the benefits to the employees.

3. Tax on pension was already there in the OLD system. So nothing to be worried about.

Now, all this above is valid for Govt employees and I think it is hugely beneficial for them. But, the NPS system was also opened to private organized and unorganized sectors. Here as well there are a lot of people (in fact majority of them) who were never thinking of retirement or pension during old age. This will benefit such people.

Only people left are active investors with a very sound knowledge of investments/personal finance or people who have financial advisors to help them. NPS is NOT for this category of people (why part is already explained in this article). However, this category of people would hardly constitute 10-20% (or even lower) of the tax paying population.

Hence, we have to acknowledge the fact that there can not be a fit for all solution in the financial world. The NPS system is actually good for 80-90% of the tax paying population and I think govt has done a great Job in bringing this system to table.

Dear Bibhu,

Your comparison view is entirely different than mine. You are concentrating on Government employees and suggesting. However, I am concentrating as a product in whole.

I completely understood on investment in NPS scheme through your blog. Thanks for better clarity. Anyhow, i have a query. Is it allowed to invest in both APY and another NPS scheme by an individual?

Dear Nataraj,

Yes, you can.

Sir, 40% nps corpus will compulsory by Annuity. This return will be taxable.

Dear Dinesh,

Yes, it is taxable.

Dear Basavaraj,

I was considering a scenario. As I approach 60 and having invested in NPS and market is soaring. Everything seems fine. Say 5 months prior to my 60th birthday, there is a market crash due to some calamity or pandemic. During the maturity of NPS, the market is at an all-time low and I have a negative gain in NPS. Would I incur a heavy loss? If so, what is the best I can do?

Dear Basu,

whether you receive pension from govt (say for Govt. employee) or regular income from annuity product, this income is always taxable at tax slabs you fall in. so, did you mean there are other pension products available in market which dont tax on regular income they produce during your retirement age?

Dear Subramaniam,

I am not defending any other retirement products here.

Agreed Sir. But are you aware of any pension products available in market which dont tax on regular income they produce during your retirement age?

Dear Subramaniam,

Currently NO.

Your above blog is very informative and gives a different point of view on NPS investment. There are always some positives and negatives with every investment product. And so the case is of NPS. As you said, there is no ideal investment that gives you all fruits together with no risk.

Among all available conservative investment opportunities which have some exposure to equity, I think NPS is still better for passive investors. Everybody can’t hire a professional advisor all the time and even though one hires, returns can’t be guaranteed.

It’s always a pleasure to read your blogs which are very thoughtful and informative. Thanks 🙂

Dear Janu,

Passive investing in NPS?

Yeah sure, 40% annuity is taxable but here are my points which proves why that tax component should not be a concern:

1. Annuity tax on 40% corpus is lower than being taxed on 100% corpus. 2. Tax on annuity comes after all the yrs you spend before retirement, so time value of money prevails (you deferred the tax by x number of yrs which was otherwise payable on accrual). 3. You ear reinvestment income on tax saved each year which will again keep compounding.

Dear Ankit,

Your reinvestment income will again keep compounding at what rate? At first, let me know how many private-sector employees able to work up to 60 years of age??

Dear sir

Iam very happy to inform you that I was very much enlightened by your information regarding NPS in your article,but as Iam 50 yrs old and comes under 30% tax bracket and want to know whether NPS is better or Jeevan Umang is better for getting the pension.So pls apprise me the pros and cons of both schemes and suggest any other schemes for getting the guaranteed pension by depositing the amt for 10 yrs

Dear Motamarri,

Whether you need pension immediately?

Hello Sir,

If NPS is not a wise choice for investment wrt Pension, then can you please suggest any other options for long term investment that provides good returns at the age of 50-55 and is less riskier

Dear Surabhi,

There is no such standard product. You have to customize it by investing in debt and equity funds or products.

Is it safe or beneficial or Risk ?

Dear Udayakumar,

Nothing is SAFE on this earth.

With the recent announcement, isn’t 60% of the corpus is tax-free at the time of retirement?

Also, would like to know your view on opting NPS under section 80CCD(2) and 80 CCD(1B), taking the account of tax saved for 30% tax bracket (money saved is invested back in Mutual Fund). Keeping the -ve aspect of lock-in period and mandatory purchase of the annuity (40%).

Does the math make any sense?

Dear Kumar,

None is talking about the remaining 40% 🙂 Never invest in a product just because it provides you tax benefits.

Just a question – if I am falling in the 30% tax bracket, investing Rs 50000 will actually save me Rs 15000, so my actual investment will be just Rs 35000. Do you think of any other instrument which will give us the 30% return right away when you invest. ?

Dear Arun,

So investing for tax saving? God bless you. Go ahead. By the way, how many private sector employees work beyond 55 years? How many aware that NPS will not give you pension? How many aware that the annuity is taxable?

Dear Basu,

An excellent piece. I have written various negative comments and your apt response.

Unfortunately it’s a bit late for me. Anyways I am about to reach 60 years, so it’s fine.

Unfortunately, another one as this is regarding my children’s NPS tier 1 account. I have decided to close the account and withdraw the amount and have gone thru your other blog on latest withdrawal policy of NPS. But there is no clarity on a particular issue which is wrt my daughter.

She went to study abroad and now has become an NRI. As per instructions in NPS site, once a resident Indian becomes NRI, the account gets closed automatically but when I checked with her POS and helpdesk of CRA, they wanted her to send a few application along with other details as NRIs can open an account. Her existing nos tier 1 account is about 5 year old( without any contribution this fiscal)

They are not clear about closure about NPS. Can you throw some light on it.

Also, my son’s NPS account is 5 year old. Can he avoid subscription this year and seek partial withdrawal when he goes to study abroad next year and then subsequently balance in the account once he becomes an NRI?

I actually opened the account when it was EEE, thanks to Arun Jaitley the tweak of partial taxation set in.

But again thanks for your enlightenment, would like to exit with less damage.

Thanks in advance

Gurumoorthy

Dear Gurumoorthy,

Your daughter can close the account. Check the conditions for partial withdrawal of NPS (my post on this).

Thanks Basuji!,

There’s a typo error in the first para.

I haven’t written any negative report or feedback to your blog. What I meant was your response to some of the negative comments to your post, which I have read.

As I mentioned in my comments, there’s no mention either in your post or in NPS website about the process of closure of NPS account of a person who started the NPS account as a resident Indian , but has now become a NRI.

Can you throw some light

Dear Gurumoorthy,

Rules of exit are same for resident as well as NRIs.

Hi sir,

I have one doubt , how these pension funds invest in corporate bonds monthly. what i observed was corporate bonds have less liquidity, so how pension funds will invest in corporate bonds when there is less liquidity.

Dear Naga,

Why you need this information?

Dear Sir,

I have been subscriber of NTPC defined contributory pension fund, which is managed by LIC..annual return is 8 to 9%..now company giving option to switch into NPS citing more benefits of NPS than LIC …can you through some light on this?

Dear XXX,

If your managed pension not have equity exposure, then better you switch to NPS.

For Central Govt employees which is the best option? selection Pensions managers or NPS Tier 1. Please clarify so that option can be choose

Dear Manohar,

As per my knowledge, they have a default option.

Unnecessarily degrading the NPS scheme

Dear Namit,

Thanks 🙂 Rather than unnecessarily saying I am DEGRADING NPS, why not you validate your points to say whatever I am saying is WRONG?

Here is why NPS is a classic investment decision. Bit complex and long but I am sure you will be pleased that I shared this with you. Please share with other people as they can also benefit. Do let me know if you still have any valid concerns.

Scenario I – Invest Rs 50,000 in NPS

Scenario II – Invest Rs 35,000 (post tax Rs 50,000 * 0.70) in Recurring Deposit

Both the scenarios consider 7% IRR

Particulars Scenario I Scenario II

Your Current Age 34 34

Your Retirement Age 60 60

Annual Investment 50,000 35,000

Your Monthly Investment 4,167 2,917

Total Invested Year 26 26

Amount Invested (Principle) 1,300,000 910,000

Total interest earned (assuming 7% returns) 2,367,248 1,656,960

Total Corpus with NPS at age of 60 3,667,248 2,566,960

Amount withdrawable at age of 60 (60% of Corpus) 2,200,349 2,566,960

Amount invested in Pension plan at age of 60 (40% of Corpus) 1,466,899 –

Annual Pension (earned from 40% of Corpus via pension plan) 87,300 –

Monthly Pension (life long) 7,275 –

Withdrawal Amount at Maturity (payable to Nominee on death) 1,466,899 –

Dear Namit,

WOOOW FIGURES 🙂 You wisely included the tax part at the time of investment. But sadly in a BIG way missed the rules that annuity will be taxable 🙂 Now coming back to the retirement age, how many of us (private sector employees) are eligible to FIT to retire at the age of 60 (I am not discussing here about their health but their professional strength). Even if you plan to retire at the of 60 years, your employer may feel you are unfit because of cheap and young labour available than you.

Its sad that a professional advisor is curious about people being unfit for employment. How about you talk about global economic recession, its impact on Indian economy, crash in equity markets once every decade wiping out people’s entire capital, India facing highest unemployment in the past 45 years etc. etc. Lets be more practical in our approach rather than talking about unemployment.

Dear Namit,

It is sad that you are unable to understand how the situation will turn in private sectors once your job efficiency decrease as you grow older. That’s what I am trying to say. Let us be a PRACTICAL approach 🙂

phas gaye nps main basu.. aab kya karey.. real eye opener

Dear Ankit,

Better to stop fresh contribution and wait for exit age.

Dear Basu,

Thanks for this wonderful articulation and eye-opener blog. Was about to invest in NPS-I, but after reading your blog, have decided otherwise.

Greatly appreciate your blogging. You have saved me the second time, the first time was from HDFC Sanchay trap.

Dear Mukesh,

Pleasure 🙂

Kindly note this point… 2019 the only valid point agaist Tax treatment of NPS 1 is you get Taxed in your pension as per slab….

…… This is a big disadvantage I agree but it can be minimized in the following way ….1 by premature withdrawls 3 times upto 25 % of contribution .

By creating NPS corpus in such a way that you fall in an Income tax Slab where you dont need to pay tax (if now its 5 lakh after 25 years it must be 10 lakh .)

Opening an NPS in name of Wife ( provided she is a house wife will also solve the problem)

Dear Sourabh,

If you are managing 25% of such withdrawal on your own before your retirement, why this READYMADE lock-in product? Whether you invest in any way, you have to buy an annuity from the commuted corpus. Then how can you save the tax? Forget about taxation. Do you feel NPS investment style is transparent and it’s debt part so safe (like many feeling)?

Hi

Once invested , how and when one can exit NPS?

Dear Ajay,

Refer my post “Latest NPS Withdrawal Rules 2018“.

Sir, Now NPS is EEE, is it worthwhile in current situation?

Dear Dipak,

Only 60% is tax-free and for the rest 40% which you buy an annuity is still taxable income.

Dear basavaraj sir,

From past fews days I am reading all information regarding nps whether it is tier-1 or tier-2 ..I am interested to invest in nps under tier-1 with amount of 2.0 LKH per year..my age is 35..I am a self employed….and alternative run some small business..

I hope you can help me with your valuable opinion of me on about what I post to you..

Thank in advance…for your help

Dear Ravi,

First read above post and if you still have an urge to invest, then let me know.

very well articulated…Thanks for sharing the facts which will not be known the many…including me… Thanks 🙂

So is APY better than this… your thoughts or analysis on APY please

Dear Malni,

With APY pension, whether you can sustain?

I am considering it for present, if people who are having high tax slab, by investing 50k straight away they are saving 15k..and if its corporate account by putting additional 50k, one can save 30k..

Dear Rupali,

Great…If your main aim of investing is TAX SAVING ONLY, then go ahead.

Dear Basuji…Is this comment sarcastic ?

I was looking for saving 15000 tax straight away using NPS. (also, I just posted a comment on this topic before completely reading the underlying comments and discussions)

Dear Arun,

Do you think NPS a great product? Do you think you have to consider only the TAX SAVING idea while investing?

Hi,

I liked the article since it gives a different perspective of NPS.

In the pursuit of creating a retirement corpus, NPS is a good retirement product to invest in.

It adds lot of variety to the portfolio.

Every product has it’s pros and cons, we need to take a call weighing them.

Thanks.

Dear Kaustubh,

If you are comfortable to digest the above-mentioned disadvantages, then GO AHEAD.

Hi Basu,

I started with NPS last year with a plan to make 20L(6% returns) to 24L (8% returns) with investment of 50K every year for 25 years. I have opened in SBI.

With this post, now i am very worried 🙁

Can you suggest me any other investment options or should i stay invested….

Dear Suresh,

Better to avoid NPS and create your own retirement corpus.

how to create own Retirement corpus.. any suggestions

Dear Malani,

By combining both equity (Mutual Funds) and debt (Debt Funds, PPF or EPF), you have to create on your own. If it is tough for you, then hire a fee-only financial planner

Hello Basu,

It is a very nice article and informative, so what would be the conclusion? Should we invest in NPS or not just in sake of current tax benefit. Or should be move to MFs?

Dear Anuj,

After going through these negatives, if you still feel NPS best suitable for you, then go ahead.

So Sir, what would be the best retirement schemes should we invest in?

Dear Anuj,

Sadly there is no such BEST RETIREMENT SCHEME.

Hi Basu

I just recently opened NPS account through SBI portal. Just one Month back. Haven’t deposited any money so far. I am yet to send my duly filled form with Photo and signature. I got my PRAN number though through email. Now i am not interested in NPS. What happens if i don’t send any further details? Will they deactivate my Pran? Can i exit my NPS now?

Dear Joseph,

If you not invested a single rupee, then does it matter that whether they activate it or not? Does it matter for you to exit?

Same concern here.

If I want to be out of NPS what go do?? So far my investment is zero.

Dear Zubin,

If your investments are zero, then why the question opt out of NPS?

I found this post very useful. One of the most informative articles on NPS for starters. Thanks for the invaluable service you are rendering by spreading financial literacy through your blogs!

Dear Jalakrut,

Pleasure 🙂

Hi. What is Tier-I and Tier-II. Pl explain.

Dear Rajesh,

Refer my post “Difference between Tier 1 and Tier 2 Account in NPS“.

Hi

Is cooperative housing society allowed to invest in mutual funds?

Thanks

Dear Hemal,

YES.

Are there any restrictions wrt funds or amount or redemption.

Is there any caveats we need to be aware of before we start putting in our society Money into MF.

Please guide.

Dear Hemal,

The restrictions are like an individual investor.

Basu Sir,

This is a good post. I was investing on NPS for last two years at 50K/annum to save tax. Actually it was opened by my previous organisation before 2 years as tier-1 NPS. The company also used to contribute some amount. Now I am no more with that company.

In this case what to do? If I stop putting money, the account will be dormant? Or Can I close the account and get my money back. Till now around 2L is there in the account.

Regards,

-Santosh

Dear Santosh,

Refer my post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

Basu Sir,

I got your point.

“The subscriber must be in the National Pension System for at least 10 years.”

In my case, the I have entered the scheme only Feb 2015, because I got enrolled by my employer that time.

Now what is the best course of action for me.

Regards,

-Santosh

Dear Santosh,

No option but to wait.

I have left my job will it affect my NPS account and invested amount in it?

Regards

Dear Salim,

NO.

Hi Basu sir, I regularly follow your posts and this was very informative and eye opening for many common people like us. thanks a lot. I have only one question running my mind. These all are current rules of NPS.

For example, in future if govt. changes rules about withdrawing amount or any other critical features like taxes on NPS funds only then i feel it may be of some use to people. Offcourse this is just an assumption if govt changes of any NPS conditions in future what do is your thought point about this.

Dear Sat,

Thanks for your kind words. Yes, you are right that in future Govt changes tax rules and withdrawal rules, then it MAY be a choice. However, we can’t risk our goal and money with the expectation that Govt will act in the future right?

Absolutely i agree we cant risk our goal with this.

Basu,

The point regarding expense ratio and the portfolio of Kotak fund is a big surprise. They in fact hold all their AUM in just mutual funds from other fund houses which means they don’t have any strategy of their own to earn superior returns.

One thing I want to point out is that they hold the funds direct plan which means the expense ratio will be hovering around 1% and not 2%.

Its very shabby on NPS part to not force these funds reveal the actual expense ratio charged.

Dear Pradeep,

Yes, my bad that I mentioned regular funds expense ratio. But still, there are doubtful questions on how and why they doing so.

Absolutely this is a bad precedent for other NPS fund houses. What Kotak is doing is giving unwarranted benefits to the other MF houses whose funds they have invested in by paying the expense ratio indirectly from NPS corpus. Kotak has carefully avoided investing in their own MFs to avoid conflict of interest. Imagine if other fund houses start doing that as well, they might gang up and invest in each others funds there by benefiting the AMCs. They will do it sooner or later.

So now an NPS consumer pays 0.01% expense to Kotak, 1-1.5% expense to many fund houses and they in turn pay STT for buying and selling stocks to govt. And finally NPS customer should pay tax to govt when they withdraw instead of buying annuity. Expenses seems to be over the roof.

Why nobody is acting on these things?

Dear Pradeep,

The issue is there is no clear-cut definition by PFRDA like how and in what way the AUM be invested by Fund Managers (it may be internally but not disclosed to investors). Hence, for investors, it is like a BLIND SWORD.

Nicely written especially about the assumption that NPS gives pension and about Kotak NPS reinvesting in multiple mutual funds!

Dear Sreekanth,

Pleasure 🙂

I think it is good to invest in it if one has exhausted all his Section 80 C options. What do you say?

Dear Rajiv,

I hope you have not read the complete post. I clearly pointed that never invest in NPS just for the sake of tax benefits you will get during investment.

Thank you. But then would not we lose money if not invest in NPS after exhausting all options under Section 80C.

Please check this article:

https://www.moneycontrol.com/news/business/personal-finance/use-nps-to-save-tax-after-exhausting-sec-80c-limit-1138311.html

Dear Rajiv,

Never invest in any product or asset just for the sake of TAX SAVING. Your first priority of investment should be to reach your financial goals.

Dear Rajiv,

Invest for the sake of achieving your financial goals rather than just for the sake of tax savings.

Yes. I am a equity lover investor. I am a very big fan of ELSS funds for tax saving and I do invest in ELSS for tax saving however, I also invest in the NPS to take benefit of the additional Rs. 50,000 under the Section 80CCD to save my taxes else I would have to pay an additional income tax.

Dear Rajiv,

I think you are not understanding my point. Never invest in any asset or product just for the sake of tax saving. Invest to achieve your financial goals. Rest is left with you to decide.

So will it be the same scenerio for investing in mutual fund as like nps.

Dear Bibhujit,

In mutual funds you have more clarity, control, and liquidity. Hence, it is not wise to compare MFs with NPS.

So can we expect more from mutual fund in long term investment as like in large cap

Dear Bibhujit,

It depends on your goal time horizon, asset allocation you do and the funds you select. Hard to say that all MF will give you good return in long run.

Dear Basavaraj,

It was really nice to read your insight on NPS for common people like me.

Just wanted to if it would be advisable to take 10% increment on Basic salary or contribute the increment@10% through Employer contribution to NPS and save 30% on it TDS.

Dear Loknath,

Never invest in any product just for the sake of TAX SAVING.